Happy Sunday friends! Another big week ahead of us!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.77T

Gold: $3254.90

Oil (WTI): $61.40

US 10Y Treasury: 4.497%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

More solid developments from @vertex_protocol to take note of!

As they recently stated:

“DeFi is evolving, and so is Vertex. 2025 marks a pivotal year as we scale Vertex Edge to 25+ EVM chains, unlock broader market listings & liquidity with VLP, and decentralize our infrastructure for resilience and security. The mission? Cementing Vertex's status at the forefront of DeFi while pioneering the transition to a new paradigm in on-chain trading.”

They continue to generate some of the highest volumes in the entire on-chain perps space, provide huge APR’s to $VRTX-stakers, and buy back significant amounts of tokens as well!

Indeed the numbers re: the above are quite staggering… as illustrated in the tweet from @Jackisnotinabox below…

Make sure to visit the Vertex site now at app.vertexprotocol.com and stay tuned as we keep providing updates on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Top 50 chains down at least 10% on the weekly include Base (#6), EOS (#22), Linea (#37), and ZKsync Era (#49).

Protocols are also mixed today. Top 100 protocols down more than 20% on the weekly include Sky (formerly MakerDAO) (#4), Stargate Finance (#45), and BEX (#69).

Here’s The Top 12 Fastest-Growing Chains By TVL On The Weekly With At Least $25M TVL (from @DefiLlama):

Here’s The Top 12 Fastest-Growing Protocols By TVL On The Weekly With At Least $25M TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Here’s The Top 12 Chains By 7 Day Stablecoin Inflow % (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @0xHyperBeat. Twitter bio states “Liquidity engine for HyperEVM”. Followed by 37 of our mutuals. h/t @NPC_68:

-Something new called @panicdotfun. Twitter bio states “coming soon.” Followed by 3 of our mutuals. h/t @AresLabs_xyz:

-Something new called @defidotspace. Twitter bio states “onchain agent arena arriving on starknet”. Followed by 5 of our mutuals. h/t @AresLabs_xyz:

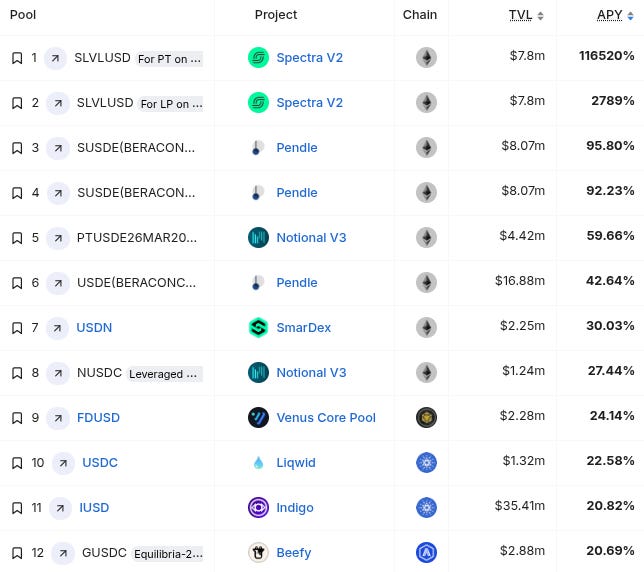

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $1M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Powell to speak on Wednesday and a bunch of earnings reports to come out on Friday, h/t @KobeissiLetter:

-$FLUID and $JUP shipping updates and more $TRUMP unlocks taking place this week, h/t @TheDeFinvestor:

-Is now the time to go long bonds? h/t @dailydirtnap:

-Important reminder from @lemiscate that EIP-7702 may end the need for EVM pre-swap token approvals soon:

-@blackbird_xyz, @meanwhilelife, @TownsProtocol, @capmoney_, and @octane_security were among notable projects raising fundraising rounds this past week, h/t @immutablejacob:

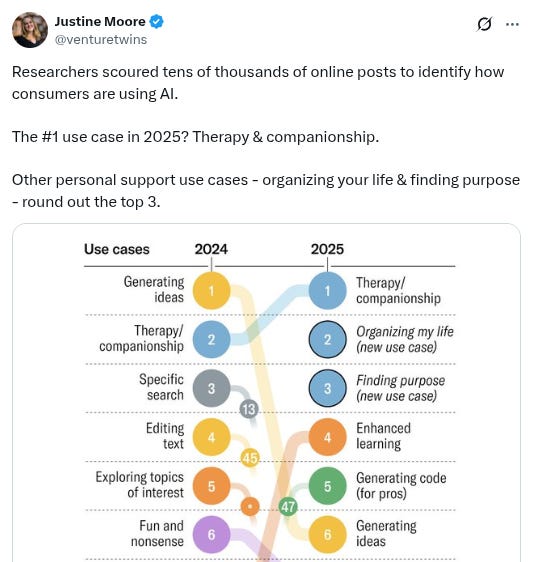

-New Harvard Business Review study (click tweet for link to it below) is generating attention for asserting that the #1 use of AI over the last year has been “Therapy and companionship”, h/t @venturetwins:

-@noise_xyz getting lots of positive attention on the TL as of late, h/t @mikee_uwu and @apixtwts:

-Ostium volumes keep surging, h/t @troyharris__:

-Funny example of real estate bros talking about Texas real estate the way crypto bros talk about upcoming bull markets:

-$BIG coin on Abstract continues to dominate the TVL, here’s a good thread from a couple days ago from @0xCygaar explaining it (click to read full thread):

-“…what the doomers fail to grasp is that [these corrections] remain buying opportunities due to policy makers willingness to step in and support the markets to avoid another gfc at all costs” - @MacroCRG:

-New macro overview from ‘Dollar Milkshake Theory’ originator Brent Johnson @SantiagoAuFund (just published three hours ago):

-New video from @theempirepod featuring @JasonYanowitz and @santiagoroel:

-New weekly macro overview from Joseph Wang @FedGuy12:

-Parting thoughts from @ViktorBunin:

Conclusion

Have a great Sunday good degens! Get some rest before another big week starts! :)

And please RT/subscribe/etc if you found this valuable!

-

-

Note

Our Official Sponsor @upshift_fi is making waves with their excellent yield-maxxing opportunities, managed by some of the biggest gigabrain yield experts in all of defi, such as MEV Capital, Tulipa Capital, Ultrayield, Ouroboros, and MNNC Group!

Many of these strategies are among the top organic APR’s you can currently find via @DefiLlama’s ‘Yields’ search function - and this is not even counting the 5x boost in points that all depositors on Upshift are currently receiving!

Click here for more info on Upshift’s $rsETH vault, currently earning 11.50% and managed by Edge UltraYield…

Click here for more info on Upshift’s $USDC lending vault, currently earning 7.26% and managed by August Digital…

And click here for more info on Upshift’s Ethena Growth sUSDe vault, currently earning 8.80% and managed by MNNC Group!

And learn more about the Upshift lore from co-founder @aya_kantor in her interview with The Block below!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers