Happy Wednesday good degens! Another busy day in ze brypto markets!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.76T

Gold: $3346.90

Oil (WTI): $62.43

US 10Y Treasury: 4.31%

Biggest Price Movers

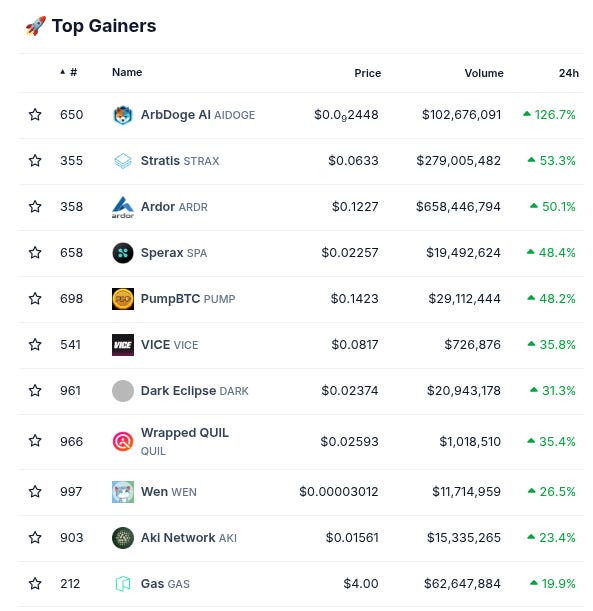

(From @coingecko top 1000, by 24 hour change)

Spotlight

More solid developments from @vertex_protocol to take note of!

-Vertex’s most recent rewards to VRTX stakers equaled an APR of 46.47%!

-Vertex is routinely one of the top 5 on-chain perps providers by volume (currently #3 over the last 24 hours on @DefiLlama and #4 over the last 7 days)

-Over 3% of the circulating VRTX supply has been bought back since January and given to stakers…

-They continue to rack up more and more chain deployments, with the goal of being on 25 different EVM chains by the end of 2025!

Make sure to visit the Vertex site now at app.vertexprotocol.com to access 60+ perps and spot markets and all sorts of exquisite yield-maxxing opportunities, follow them on Twitter for more updates, and stay tuned as we keep providing updates on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Top 50 chains green on all three timelines (daily, weekly, monthly) include Solana (#2), Tron (#4), Aptos (#11), Sonic (#12), Core (#14), Hyperliquid L1 (#15), and Sei (#16).

Protocols are mixed today as well. Top 50 protocols green on all three timelines (daily, weekly, monthly) include JustLend (#9), BlackRock BUIDL (#14), SUN (#36), Convex Finance (#37), Tether Gold (#42), and Paxos Gold (#44).

Here’s The Top 12 Fastest-Growing Chains By TVL On The Monthly With At Least $10M TVL (from @DefiLlama):

Here’s The Top 12 Fastest-Growing Protocols By TVL On The Monthly With At Least $10M TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Token-Holder’s Revenue (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (all types, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-11.50% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on USDC Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-7.33% APY on USDC lending strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-14.20% APY on USDO++ on Usual h/t DefiLlama research

-11.61% APY on GHO on Aave V3 h/t DefiLlama research

-11.88% APY on SUSDE on Echelon Market (Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @onyxdotbond. Twitter bio states “Onyx is a platform for tokenizing revenue-generating businesses. Our mission is to make it infinitely more valuable to build a business onchain.” Followed by 8 of our mutuals. h/t @twindoges:

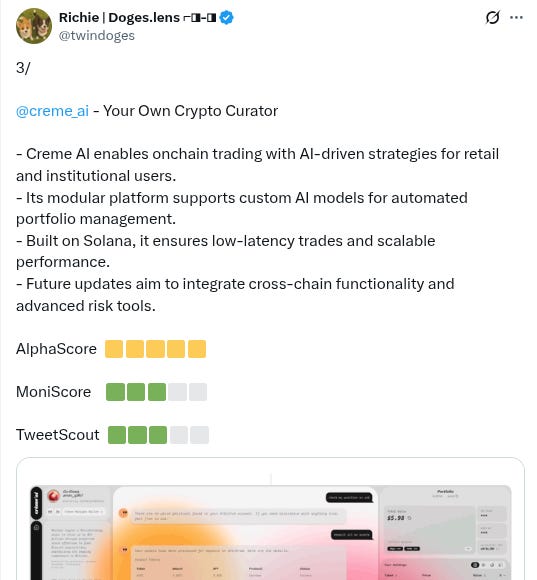

-New project called @creme_ai. Twitter bio states “Your Own Crypto Curator”. Followed by 3 of our mutuals. h/t @twindoges:

-New project called @hyperpnl. Twitter bio states “hyping your capital. the #1 decentralized prop trading protocol on top of hyperevm and @HyperLiquidX”. Followed by 7 of our mutuals. h/t @twindoges:

-New project called @SwappeeFinance. Twitter bio states “Dust-to-wealth machine for boosters, a public good for @berachain powered by @SmileeFinance | One-click claim all your validators' incentives.” Followed by 9 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

-Janover continues buying $SOL in its attempt to become the ‘MicroStrategy of Solana’, and there is lots of chatter about Movement and its co-founder @rushimanche going on leave or something, though he denied this in another tweet, h/t @Tyler_Did_It:

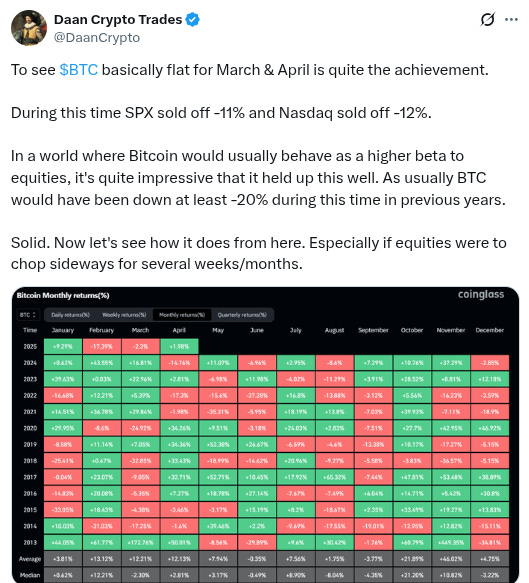

-Bitcoin holding up reasonably well considering poor stock performance of late, h/t @DaanCrypto:

-Market currently pricing in a 75% chance of a Fed rate cut in June, h/t @truflation:

-Announcement today that Circle will deploy native USDC on Monad when the new chain launches is generating attention:

-@KaitoAI now integrated with @pendle_fi, h/t @RightSideOnly:

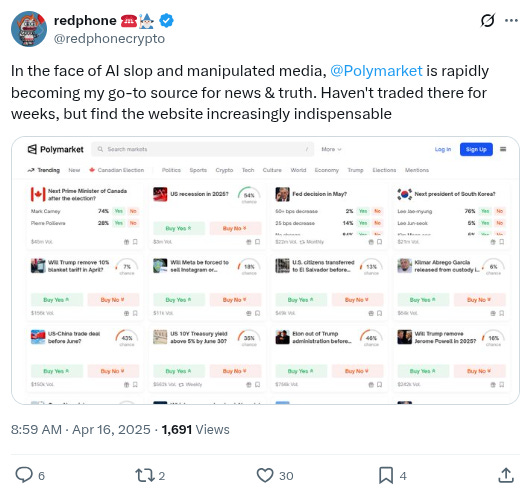

-Polymarket still maintaining quite a bit of mindshare despite election being over, h/t @redphonecrypto:

-US 30 year mortgage rates are back up to 7.50%:

-Ostium continue to claim more and more mindshare, h/t @sandraaleow:

-Also seeing some smart accounts we follow talking about @TreehouseFi, h/t @0xGeeGee:

-Important security alert from @0xngmi of @DefiLlama, that scammers are buying old defi domains and replacing the frontend with drainers:

-Another security alert (thread)- from @nicksdjohnson- that generated massive discussion today (over 2k retweets):

-New macro interview from @Blockworks_ from @MelMattison1:

-New @Unchained_pod video featuring @Matt_Hougan and more:

-New @Jesseeckel_ video on the current situation in macro/crypto:

-Parting wisdom from @thedefiedge:

Conclusion

Happy Wednesday good degens! Stay alert out there!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.