Happy Thursday friends! Exciting times we are living in!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.75T

Gold: $3307.80

Oil (WTI): $64.35

US 10Y Treasury: 4.307%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Are you bullish on HyperEVM defi good anon?

Well our Official Sponsor @upshift_fi is deep in the heart of it, curating the best yield opportunities available!

As detailed in their recent thread:

“Partnering with @0xHyperBeat and @ultrayieldapp, the hbHYPE vault will dynamically allocate $HYPE deposits across HyperEVM DeFi protocols. Delta-neutral strategies, funding arbitrage and more will be deployed to maximize returns. hbHYPE democratizes institutional yield for $HYPE holders…

The hbHYPE vault offers incentives from @Hyperlendx, @HypurrFi, @HyperSwapX, @0xHyperbeat, @TimeswapLabs, @silhouette_ex and more. Early depositors can also earn 5x Upshift points… Deposit to earn yield on your HYPE...”

Check out the tweet below from @alpha_pls from a recent thread he did of top HyperEVM opportunities to learn more about the above!

And make sure to follow Upshift on Twitter for more updates + alfa!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Best-performing chains on the weekly with at least $50M TVL are Movement, Unichain, and Hyperliquid L1.

Protocols are also mixed today. Best-performing protocols on the weekly with at least $50M TVL are ETH Mainnet yield protocol Latch, Hyperliquid L1 CDP protocol Felix, and Ostium, categorized as an Arbitrum derivatives protocol.

Here’s The Top 12 Chains By TVL (from @DefiLlama):

Here’s The Top 12 Protocols By TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Here’s The Top Chains By 7 Day Stablecoin Inflow % (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New/newish project called @eth_strategy that we apparently haven’t highlighted yet… Twitter bio states “busy saving ethereum. turn on notifications.” Followed by 115 of our mutuals. h/t founder @CloutedMind:

-New project called @predixfun. Twitter bio states “AI powered PvP Prediction Market | Built on Base & Solana | 2nd Solana Seoul Hackathon (Wormhole Track) @Solana”. Followed by 3 of our mutuals. h/t @twindoges:

-New project called @bundle_dot_fun. Twitter bio states “Solana-powered ETF creation & investing platform.” Followed by 2 of our mutuals. h/t @twindoges:

-Something new called @StitchAI_hq. Twitter bio states “Decentralized Knowledge Hub for AI 🏆 Winner of BNB AI Hack”. Followed by 5 of our mutuals. h/t @twindoges:

-A new project called @SolidoMoney has been added to @DefiLlama, categorized as a CDP protocol on the Supra blockchain. Twitter bio states “Supercharging DeFi on the Supra blockchain.” Followed by 1 of our mutuals.

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (all types, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Jerome Powell made some statements yesterday that were widely regarded as extremely hawkish, but did also make some neutral-to-positive statements about crypto that generated attention as well, h/t @WuBlockchain:

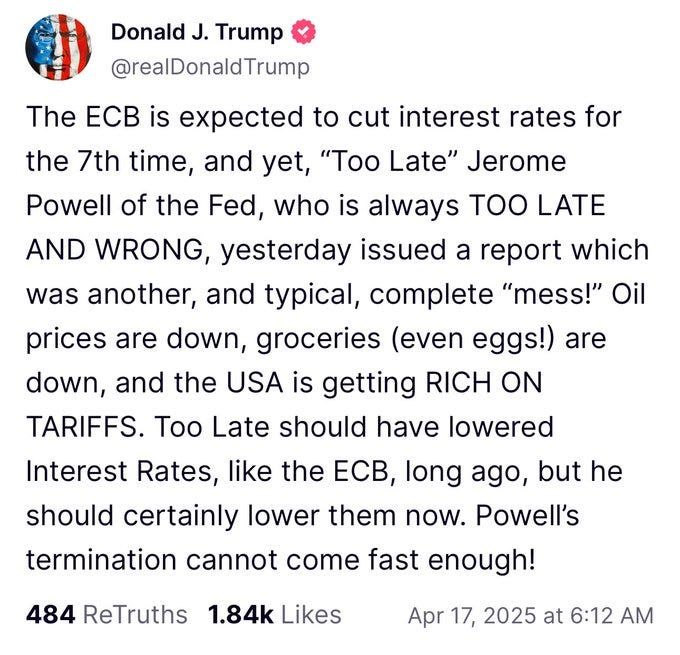

-President Trump attacked Powell after Powell’s comments yesterday, stating that the Fed “should have lowered interest rates… long ago”, that Jerome Powell is “always TOO LATE AND WRONG”, and that “Powell’s termination cannot come fast enough!”:

-There is increasing support for the idea that the Fed indeed does have too much independence, and that the Executive Branch should have more ongoing oversight of it, much like it does with the Treasury Department:

-Pendle partnering with Amber Group and Jupiter launches Jupiter Pro this week, plus other recent defi headlines c/o @TheDeFinvestor:

-Some significant $APT-incentives for Aave’s deployment to Aptos, h/t @tomwanhh:

-Seeing lots of comments about individual L2’s struggling to maintain mindshare, example from @kaiynne below on Kraken’s L2:

-Real estate and business data in the US is showing more signs of cooling, h/t @onechancefreedm:

-Interesting tweet from Curve founder @newmichwill on @TacBuild and TON defi:

-Review of @noise_xyz, one of the new projects we see the most chatter about as of late, from @apixtwts:

-Reminder that there’s a great section on @DefiLlama for tracking token unlocks, h/t @Route2FI:

-Interesting new article on Bitcoin from @fejau_inc, postulating that it may be the best asset to bet on in the near to medium-term future. To quote from it: “And so, for me, a risk seeking macro trader, Bitcoin feels like the cleanest trade after the trade here. You can't tariff bitcoin, it doesn't care about what border it resides in, it provides high beta to a portfolio without the current tail risks associated with US tech, I don't have to take a view on the European Union getting their shit together, and provides a clean exposure to global liquidity, not just american liquidity.

This market regime is what Bitcoin was built for. One the degrossing dust settles, it will be the fastest horse out of the gate. Accelerate.”

-Video of Jerome Powell from yesterday that is generating so much attention:

-New @LynAldenContact interview from @natbrunell on all things macro and Bitcoin:

-New interview with @ryanberckmans from @DeFi_Dad and @Nomaticcap:

-New @JackFarley96 interview with macro expert Julien Brigden:

-New roundtable from @Unchained_pod (published yesterday) featuring @ramahluwalia, @joemccann, @jseyff, and more:

-New Blocmates video featuring @Grantblocmates interviewing Ethena’s Head of Research @ConorRyder:

-Parting wisdom from @NateGeraci:

Conclusion

Have a great Thursday and stay hypervigilant out there friends!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

More solid developments from @vertex_protocol to take note of!

-Vertex’s most recent rewards to VRTX stakers equaled an APR of 46.47%!

-Vertex is routinely one of the top 5 on-chain perps providers by volume (currently #4 on @DefiLlama over the last 7 days)

-Over 3% of the circulating VRTX supply has been bought back since January and given to stakers…

-They continue to rack up more and more chain deployments, with the goal of being on 25 different EVM chains by the end of 2025!

Make sure to visit the Vertex site now at app.vertexprotocol.com to access 60+ perps and spot markets and all sorts of exquisite yield-maxxing opportunities, follow them on Twitter for more updates, and stay tuned as we keep providing updates on everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.