Happy Sunday good degens!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.77T

Gold: $3341.30

Oil (WTI): $64.68

US 10Y Treasury: 4.333%

Biggest Price Movers

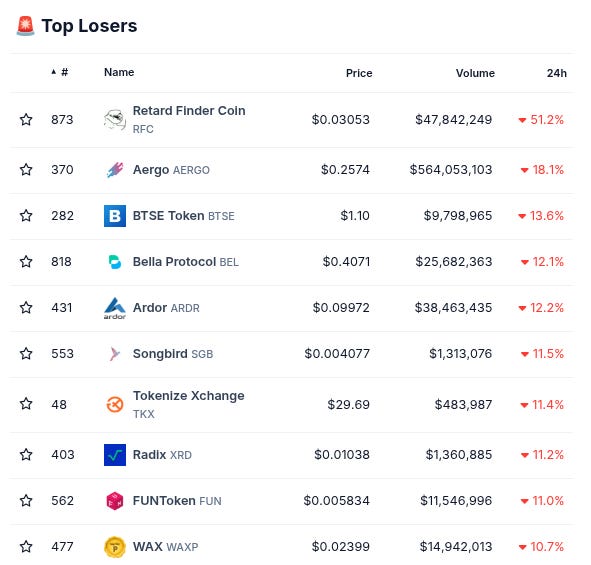

(From @coingecko top 1000, by 24 hour change)

Spotlight

The team at @vertex_protocol keeps pumping out bullish stats!

-Vertex’s most recent rewards to VRTX stakers equaled an APR of 46.47%!

-Vertex is routinely one of the top on-chain perps providers by volume (currently #5 on @DefiLlama over the last 7 days)

-Over 3% of the circulating VRTX supply has been bought back since January and given to stakers…

-Their omnichain-liquidity architecture Vertex Edge recently passed $200B in all-time volume…

-They continue to rack up more and more chain deployments, with the goal of being on 25 different EVM chains by the end of 2025!

Make sure to visit the Vertex site now at app.vertexprotocol.com to access 60+ perps and spot markets and all sorts of exquisite yield-maxxing opportunities, follow them on Twitter for more updates, and stay tuned as we keep providing updates on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Top 25 chains up at least 10% on the monthly include Sonic (#12), Hyperliquid L1 (#14), BSquared (#19), Unichain (#20), and Hemi (#24).

Protocols are also mixed today. Fastest-growing protocols on the weekly with at least $1M TVL are Tangible, Manta MYield, GrowiHF, Bearn, and Napier.

Here’s The Top 12 Fastest-Growing Chains By TVL On The Weekly With At Least $1M TVL (from @DefiLlama):

Here’s The Top 12 Protocol By TVL (from @DefiLlama):

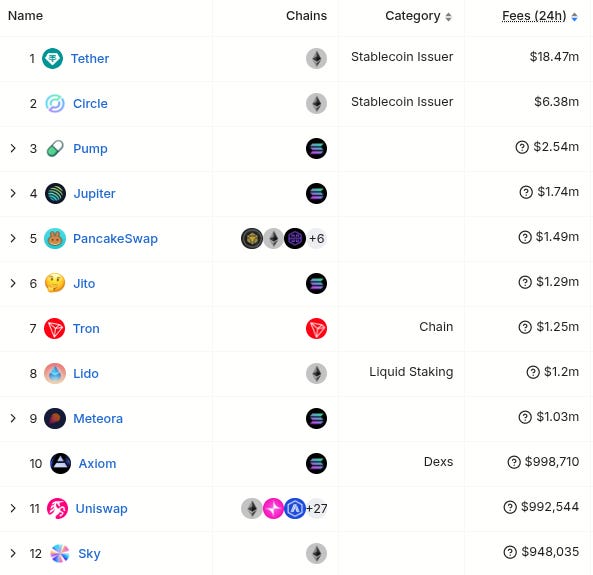

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (all types, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-11.50% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on USDC Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-7.24% APY on USDC lending strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-21.66% APY on IUSD on Indigo (Cardano) h/t DefiLlama research

-11.69% APY on GHO on Aave V3 h/t DefiLlama research

-11.66% APY on SUSDE on Echelon Market (Aptos) h/t DefiLlama research

-11.60% APY on USDO++ on Usual h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @Maneki_DeFi. Twitter bio states “The first compassionate DeFi provider. Discover, execute and optimize yield opportunities with AI. Built by @rivoxyz”. Followed by 6 of our mutuals. h/t @amiralnadi:

-Something new called @cambrian_ai. No Twitter bio. Followed by 16 of our mutuals. h/t @AresLabs_xyz:

-New project called @o1_exchange. Twitter bio states “The fastest trading platform on chain – Built for speed. Designed for edge. Made for traders.” Followed by 5 of our mutuals. h/t @AresLabs_xyz and @imrankhan:

Important News And Analysis

-Interesting historical Easter prices for $BTC:

-Is $BTC beginning to copy gold’s recent pattern of outperformance vs equities? h/t @DaanCrypto:

-Lot of focus on Initia going into this week, which has its Mainnet and TGE on April 24th, h/t @TheDeFinvestor:

-Following stat that SOL has flipped ETH in ‘staking market cap’ is generating lots of debate today, h/t @ASvanevik:

-Relatively quiet week ahead in terms of macro schedule, h/t @KobeissiLetter:

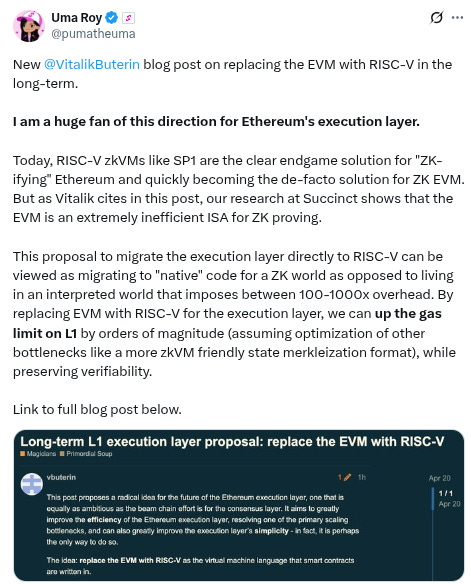

-New Vitalik forum post is generating attention, h/t @pumatheuma:

-Continued excitement about the @HyperSwapX airdrop, h/t @MingoAirdrop:

-Schwab expects to offer crypto spot trading within the next 12 months, h/t @HHorsly and @NateGeraci:

-Ongoing debate about Ethereum’s future and mainnet vs L2’s and everything else, h/t @TrustlessState and @haydenzadams:

-TON defi and @TacBuild continuing to generate attention, h/t @mattdotfi:

-Zora usage increasing as it remains under the spotlight this week, h/t @0xSharples:

-Another fantastic macro interview with Doomberg (highly recommended):

-New video from the @coinbureau channel on the current state of the crypto markets:

-New @Unchained_pod interview with Securitize CEO Carlos Domingo, and Ethena co-founder Guy Young:

-Weekly macro overview from Joseph Wang @FedGuy12:

-New macro video from ‘Dollar Milkshake Theory’ originator Brent Johnson @SantiagoAuFund:

-Parting wisdom from @BaroOdyssey via @QuotableCrypto:

Conclusion

Have a great Sunday friends and make sure to do some good grass-touching! :)

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.