Happy Monday friends! The excitement continues!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.85T

Gold: $3426.10

Oil (WTI): $62.90

US 10Y Treasury: 4.377%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

The HyperEVM trenches continue to attract more and more attention, both from Hyperliquid maximalists and airdrop farmers alike!

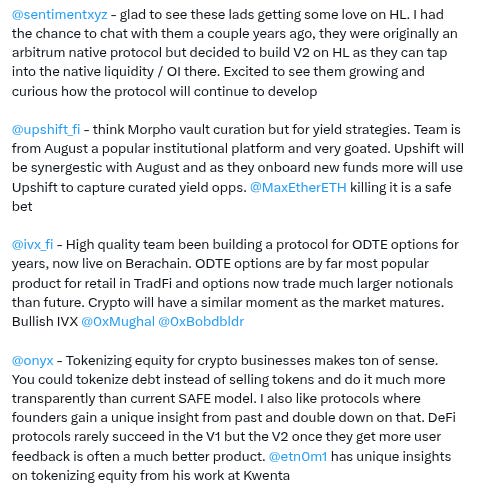

If you plan to explore them yourself, our Official Sponsor @upshift_fi has one of the best opportunities out there!

As detailed in their recent thread:

“Partnering with @0xHyperBeat and @ultrayieldapp, the hbHYPE vault will dynamically allocate $HYPE deposits across HyperEVM DeFi protocols. Delta-neutral strategies, funding arbitrage and more will be deployed to maximize returns. hbHYPE democratizes institutional yield for $HYPE holders…

The hbHYPE vault offers incentives from @Hyperlendx, @HypurrFi, @HyperSwapX, @0xHyperbeat, @TimeswapLabs, @silhouette_ex and more. Early depositors can also earn 5x Upshift points… Deposit to earn yield on your HYPE...”

Check out the tweet below from @alpha_pls from a recent thread he did of top HyperEVM opportunities to learn more about the above!

And make sure to follow Upshift on Twitter for continued updates!

Biggest TVL Movers + Other Interesting Data

Chains are mostly green today. Fastest-growing chains on the weekly with at least $20M TVL are Unichain, Bitlayer, and Hyperliquid L1.

Protocols are also mostly green today. Fastest-growing protocols on the weekly with at least $20M TVL are Tangible, Napier, and Splash Protocol.

Here’s The Top 12 Chains By TVL (from @DefiLlama):

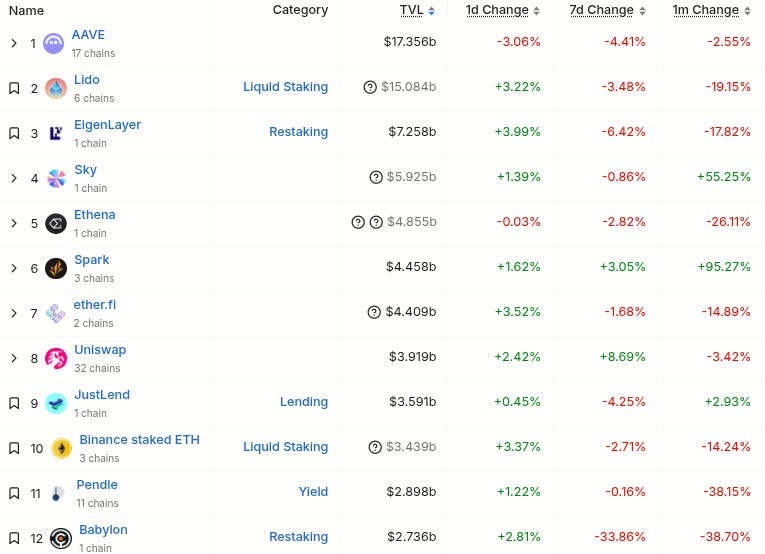

Here’s The Top 12 Protocols By TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @weebdotfun. Twitter bio states “A new way to launch & trade memecoins with your friends”. Followed by 23 of our mutuals. h/t @CoinBeatsxyz:

-New project called @sudobaseai. Twitter bio states “the substrate for world agents.” Followed by 5 of our mutuals. h/t @CoinBeatsxyz:

-New project called @Udonfinance has been added to @DefiLlama, categorized as a dex on KUB chain. Twitter bio states “Seamless DEX on KUB @kubchain”. Not followed by any of our mutuals but has over $1M TVL so including it.

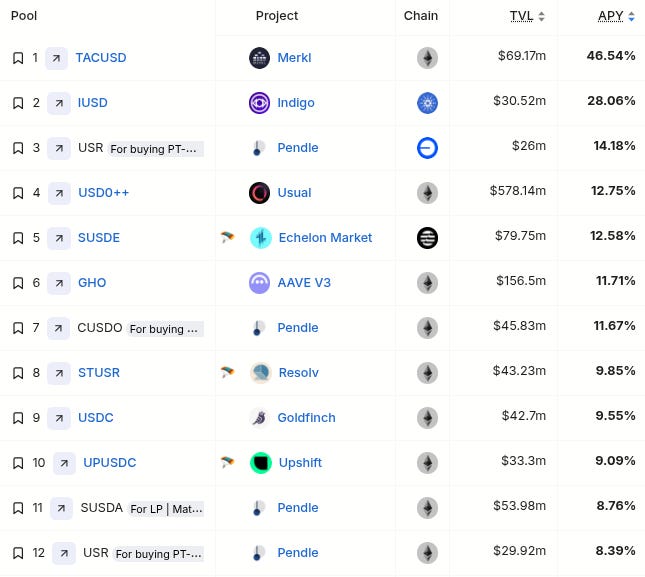

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Vitalik’s post yesterday about eventually shifting to RISC-V continues to generate lots of attention, and Zora has announced its TGE is set for this week, h/t @Tyler_Did_It:

-Trump continues to attack Jerome Powell via social media, calling for him to lower interest rates, h/t @FedGuy12:

-Related reminder from @FedGuy12 that the Trump administration wants a lower USD:

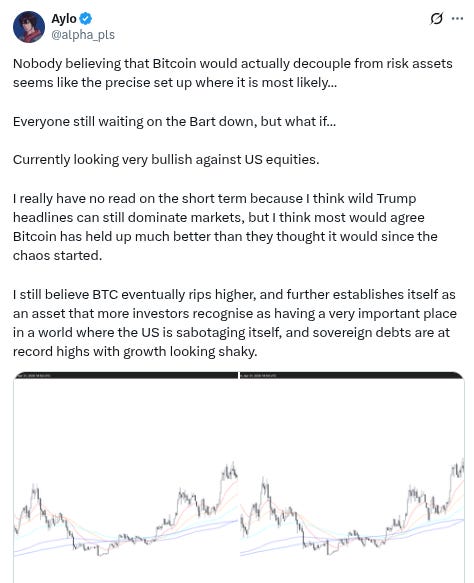

-Much discussion today about whether $BTC is decoupling from stocks and beginning to trade in line with gold instead (which continues its massive outperformance, hitting new ATH’s over the last 24 hours), h/t @MelMattison1:

-@alpha_pls on the same, and the omnipresent threat that Trump announcements can spike markets way up or down at a moment’s notice:

-Crypto exchange volumes are down, h/t @LDNCryptoClub:

-Euler’s massive comeback arc continues to generate much attention, h/t example from excellent thread by @AleaResearch:

-Continued attention on Ostium, which seems to be the new big focus in airdrop circles, h/t @daddysether:

-Much debate on MegaETH vs Monad on the TL, example c/o @ahboyash:

-Interesting thoughts on some up-and-coming projects from GammaSwapLabs co-founder @0xDeFiDevin:

-Is the era of ‘jobs’ over? And is “what will the kids do?” the trillion dollar question? h/t @based16z:

-New video of TA and general market analysis from @DaanCrypto (published four hours ago):

-New roundtable discussion from @BanklessHQ on the future of Ethereum:

-New @noahseidman crypto/macro livestream (airing live as we publish this):

-New @coinbureau livestream on the current state of crypto (aired two hours ago):

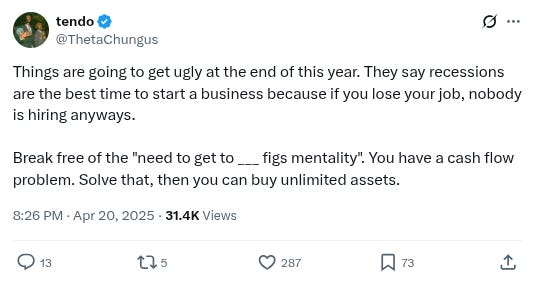

-Is cashflow the key to benefitting from recessions? h/t @ThetaChungus:

-”if you just envision your life as if you're playing a video game w/ maxxed out stats it gets way more fun” - parting wisdom from @blknoiz06:

Conclusion

Happy Monday friends and stay alert out there this week!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

Take note good degens! @maplefinance just hit $1B in TVL last week!

This milestone marks the next step in an absolutely massive comeback arc for Maple, who persevered through the depths of the bear market to achieve unprecedented success today, just as the nascent defi renaissance starts heating up!

If you want to learn more about Maple, its history, and what is coming next after this latest milestone, check out the following:

-A new interview Maple co-founder @joe_defi did with @DeFi_Dad and @Nomaticcap

-A recent discussion between Maple co-founder @syrupsid and @OmniFDN

-A new spaces Maple recently did with new partner @sparkdotfi and Spark-backer @pythianism….

And a new interview @syrupsid just did with The Defiant’s @CamiRusso below!

And as always, make sure to follow Maple on Twitter for more updates, and stay tuned as we continue highlighting everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.