Happy Tuesday friends! Crazy times we are in!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.95T

Gold: $3423.90

Oil (WTI): $64.55

US 10Y Treasury: 4.379%

Biggest Price Movers

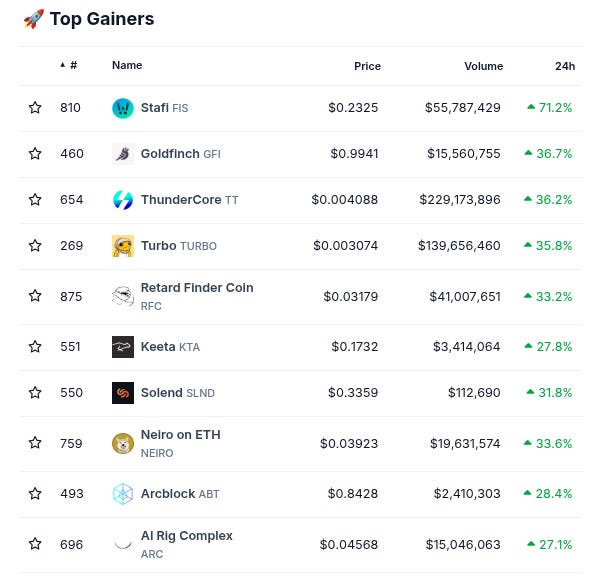

(From @coingecko top 1000, by 24 hour change)

Spotlight

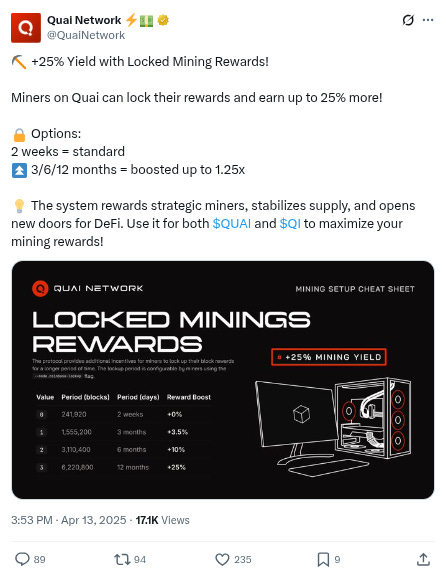

One of the most fascinating new projects that is generating massive attention right now in crypto is @QuaiNetwork!

Quai Network is essentially a scalable, EVM-compatible proof-of-work system based around the idea of tokenizing computing energy. It is also GPU-mineable, much to the excitement of mining-enthusiasts!

It is based upon a dual-token model of $QUAI and $QI - with $QUAI as the main token and $QI as an “energy dollar” or “flatcoin”.

If you want to learn more about $QUAI and $QI and how the dual token model and everything else works, check out the brilliant new interview from a few days ago that The Calculator Guy @phtevenstrong did with Quai Network’s Dr K @mechanikalk!

And make sure to follow Quai on Twitter for more updates, and stay tuned as we continue highlighting everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are very green today. Fastest-growing chains on the weekly with at least $1M TVL are Unichain, KUB, and Mode.

Protocols are also very green today. Fastest-growing protocols on the weekly with at least $1M TVL are uncategorized Sui + Aptos protocol BlueMove, multichain EVM lending protocol Term Structure, and Bitlayer CDP protocol BitZap yUSD.

Here’s The Top 12 Chains By TVL (from @DefiLlama):

Here’s The Top 12 Protocols By TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (all types, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-10.80% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on USDC Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-7.02% APY on USDC lending strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-28.06% APY on IUSD on Indigo (Cardano) h/t DefiLlama research

-11.85% APY on GHO on Aave V3 h/t DefiLlama research

-12.62% APY on USDO++ on Usual h/t DefiLlama research

-12.42% APY on SUSDE on Echelon Market (Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @supcoin_ai. Twitter bio states “SUP✌️ The first rule of $SUP? You pretend you knew about $SUP first.” Followed by 7 of our mutuals. h/t @DidiTrading:

-New project called @Lnd_fi has been added to @DefiLlama, categorized as a lending protocol on Sonic. Twitter bio states “Interconnected Non-Custodial Money Markets. Lend, Borrow and Earn freely”. Followed by 8 of our mutuals.

Important News And Analysis

-Gold and crypto jumping as macro crisis rolls on, and a number of crypto entities are pursuing bank charters as the crypto x tradfi synthesis continues ramping up, h/t @Tyler_Did_It:

-Lots of talk about how this stock market fall looks very similar to the March 2020 one (though not quite as deep so far), h/t @MelMattison1:

-Much focus on Bitcoin’s bounce and whether it is now going to mirror gold’s outperformance as a hedge against chaos/debasement/etc, h/t @Matt_Hougan:

-Some type of exploit took place or is taking place involving @btcmapp (below tweet from @blockaid_ was published an hour ago):

-Interesting new acquisition, of @kado_money by @swappedcom, as many postulate that we will see an increasing amount of M&A in crypto this year, h/t @vince_dowdle:

-Interesting update from Coinbase on a token recovery tool, relating to a topic that’s generated lots of attention, h/t @DegenerateNews:

-Have heard several of our gigabrain friends mention DTF’s from @reserveprotocol as of late, h/t example from excellent thread via @Degenerate_DeFi below:

-Seeing increased talk about @FogoChain, h/t good long form piece on it from @ManoppoMarco below:

-Also seeing increased focus on Plasma as well, h/t @0x_Abdul:

-Good list of interesting new projects to check out, from @zacxbt:

-Great article on marketing and storytelling in crypto from @DeFiDave22:

-Interesting tweet on the confluence of drone warfare and the current economic debates, from PMC and macro-enthusiast @RadiganCarter:

-New David Lin interview with @LukeGromen and @DrJStrategy:

-New roundtable from @Unchained_pod featuring @krugermacro, @ramahluwalia, and more:

-New interview with Ethena’s Guy Young from @theempirepod:

-New @Jesseckel video on why we haven’t had an alt-season:

-Parting wisdom from @BackTheBunny c/o @QuotableCrypto:

Conclusion

Have a great Tuesday and stay alert out there friends!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.