Happy Monday friends! Start of another big week!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.04T

Gold: $3,348.50

Oil (WTI): $61.61

US 10Y Treasury: 4.216%

Biggest Price Movers

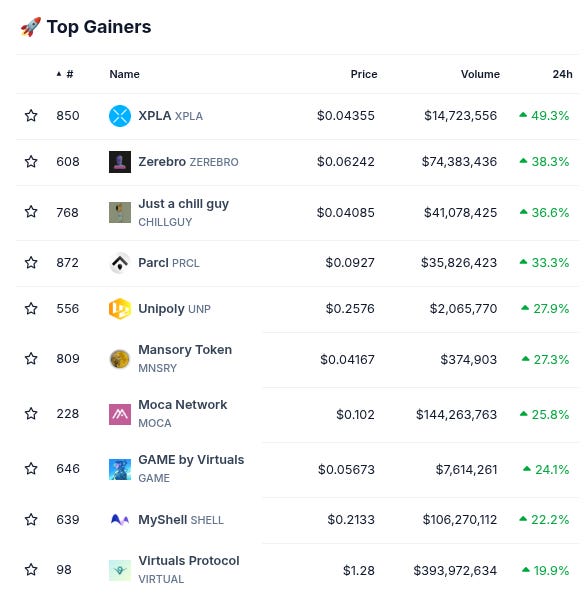

(From @coingecko top 1000, by 24 hour change)

Spotlight

Much is going on with our friends at @QuaiNetwork!

-Decentralized mining pools are live…

-Quai’s Kaito rewards program rolls on…

-New GameFi project @QuaiBattle just went live on Quai mainnet…

-And their Quai Friday call just took place (click here to listen to all the latest updates on everything Quai-related!)

Once again, Quai Network is an extremely cool new EVM-compatible, GPU-mineable, POW (proof-of-work) blockchain based around the idea of tokenizing computing energy…

It is based upon the dual-token model of $QUAI and $QI - with $QUAI as the main token and $QI as an “energy dollar” or “flatcoin”.

If you want to learn more about $QUAI and $QI and how the dual token model and everything else works, check out the latest interview that The Calculator Guy @phtevenstrong did with Quai Network’s Dr K @mechanikalk below!

And make sure to follow Quai on Twitter for more updates, and stay tuned as we continue highlighting everything they are doing!

Biggest TVL Movers + Other Interesting Data

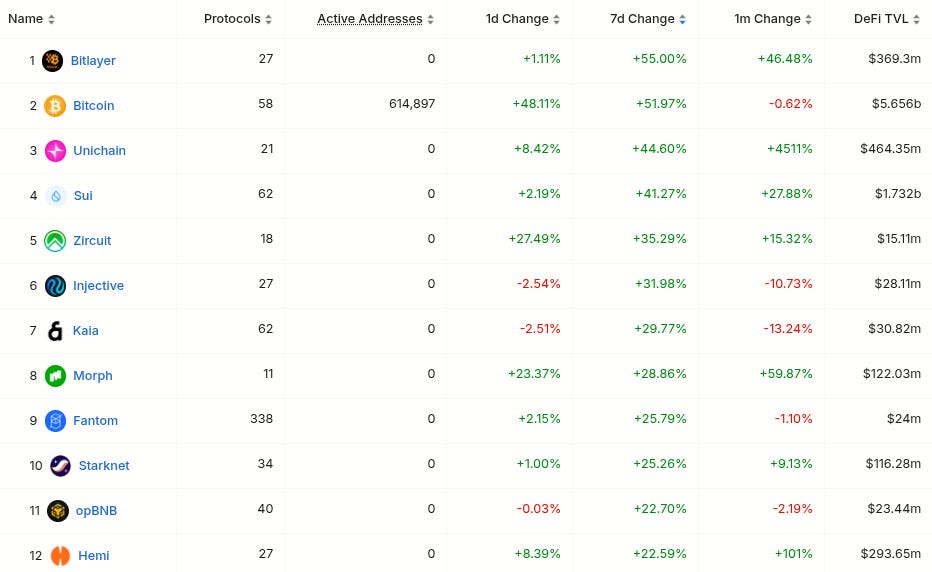

Chains are pretty darn green today. Top 20 chains up at least 20% on the weekly include Bitcoin (#4), Sui (#9), and Unichain (#16).

Protocols are also quite green. Top 60 protocols up at least 20% on the weekly include Babylon Protocol (#7), and Dolomite (#53).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $10M TVL (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $10M TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (all types, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-10.80% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on USDC Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-7.02% APY on USDC lending strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-36.63% APY on IUSD on Indigo (Cardano) h/t DefiLlama research

-12.27% APY on GHO on Aave V3 h/t DefiLlama research

-13.82% APY on USDO++ on Usual h/t DefiLlama research

-11.02% APY on SUSDE on Echelon Market (Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @AkrasiaAI. Twitter bio states “Akrasia Labs - Building humanity's mental firewall Product lab building in the intersection of AI and Crypto Agent: @SternSeesYou No coin yet”. Followed by 7 of our mutuals. h/t @AresLabs_xyz:

-Something new called @AV_Launchpad. Twitter bio states “Launch tokens tied to real AI agents. A new way for developers to raise capital, build community, and ship on-chain utility.” Followed by 5 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

-Ethereum tech proposals are generating a lot of discussion today, h/t @TheBlock__:

-Saylor announces more Bitcoin buys, reminder to follow @thedefivillain for the best Saylor coverage + explanations:

-Top pre-TGE (pre-token) projects on Kaito currently, as ranked by mindshare, are pumpdotfun, Infinex, Monad, Mitosis, Theoriq, MegaETH, Sophon, and Succinct, h/t @sandraaleow:

-Good breakdown of above-mentioned MegaETH ecosystem from @CryptoStreamHub (is very long tweet with detailed thoughts on each so click to read in full):

-$UNI generating increased attention, h/t @NPC_68:

-Sui dex volumes are apparently surging, h/t @WuBlockchain:

-The price of Monero/$XMR spiked over the last 24 hours when someone bought a ton of it with stolen $BTC, h/t @tayvano_:

-Absolutely wild stat that Warren Buffett’s Berkshire Hathaway owns almost 5% of all US treasury bills in circulation:

-Is UX the key ingredient to success this cycle? h/t @0xNairolf:

-Memecoins are now down to #3 in mindshare by category, after dominating it for much of the last year, h/t @TheDeFinvestor:

-Important reminder to build your loss-cutting muscles, from @thedefiedge:

-New video of TA and general market analysis from @DaanCrypto:

-New livestream from this morning from the @coinbureau channel on all current crypto news:

-New crypto/macro livestream from @noahseidman (just aired two hours ago):

-New @BanklessHQ interview with Frax founder @samkazemian:

-New @patfscott Dynamo Defi video on how to use @DefiLlama:

-New video of TA and market analysis from @docXBT:

-Good reminder that it is the times when prices are down and people are bored and everyone is sleeping on crypto (like right now!) that the best opportunities are seized - from @Globalflows via @QuotableCrypto:

Conclusion

Happy Monday good degens! Stay alert out there!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.