Happy Saturday friends! Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.266T

Gold: $2885.60

Oil (WTI): $70.63

US 10Y Treasury: 4.491%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Lots of bullish news from the team at @vertex_protocol!

They just released their new update ‘Vertex V3: The Vision For 2025 And Beyond’ outlining all the plans that are in the works!

“Vertex’s roadmap for 2025 is clear and ambitious:

☑️ 25+ EVM chains via Vertex Edge

☑️ Vertex Liquidity Pool (VLP)

☑️ Fully decentralized sequencer infrastructure

DeFi is moving fast.

Vertex moves faster.

Are you ready for the next era of on-chain finance?”

Click here to read it in full!

Also check out the thread below to get all the weekly news on Vertex, visit their site now at app.vertexprotocol.com to get started trading 60+ perps and spot markets, and make sure to follow them on Twitter for more updates!

Biggest TVL Movers + Else

Chains mostly red today. Fastest-growing chains on the weekly with TVL at least $25M are Bifrost Network, opBNB, and Sonic.

Protocols are also quite red today. Fastest-growing protocols on the weekly with TVL at least $25M are Mars Protocol, Reti Pooling, SatLayer, Royco Protocol, and Dolomite.

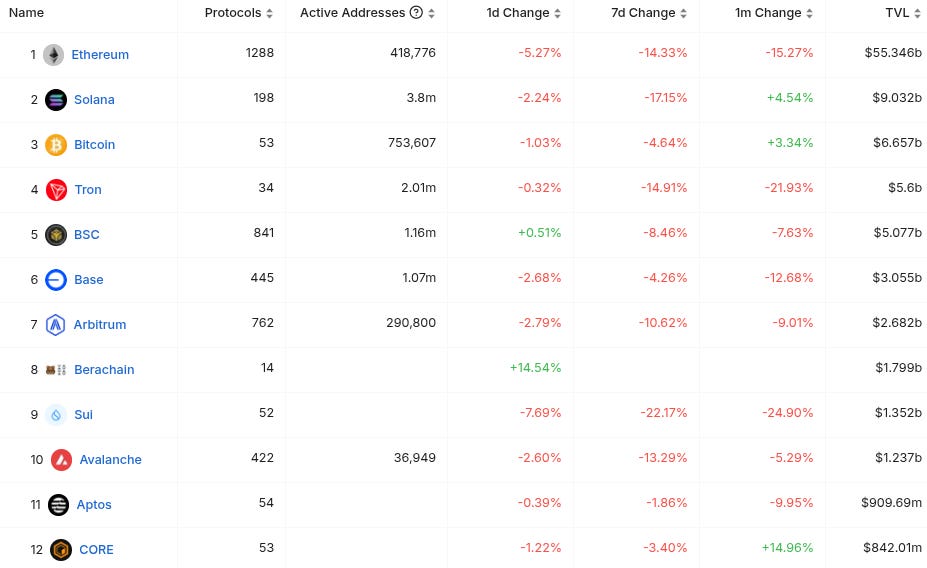

Here’s The Top 12 Chains By TVL (from @DefiLlama):

Here’s The Top 12 Protocols By TVL (from @DefiLlama):

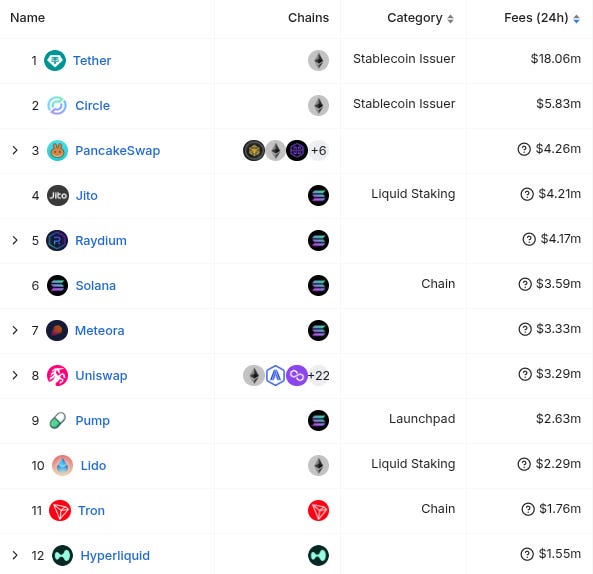

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day, and we also include every newly launched protocol added by @DefiLlama that has at least some TVL or is followed by at least some of our mutuals - hence disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @SnakeOnSonic has been added to @DefiLlama. Is categorized as an Algo-Stable on Sonic. Twitter bio states “Better than ever Algo pegged coin to $S on @SonicLabs”.

-New project called @moveflowlabs_ has been added to @DefiLlama. Categorized as a Payments protocol on EDU Chain. Twitter bio states “Token management infra for vesting, airdrop, payroll and subscription. Backed by @Aptos @OVioHQ @opencampus_xyz .” Followed by 1 of our mutuals.

-New project called @playcookdotfun. Twitter bio states “🍳 Degen arcade...” Followed by 2 of our mutuals.

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (all types, $20M+ TVL) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Bitcoin in ‘Optimism’ but alts in ‘Depression’? h/t @cryptoklotz:

-Many more launches potentially taking place in Q1, such as Story, MegaETH, Initia, Eclipse, Solayer, and possibly Monad, h/t @0xGeeGee:

-Bitcoin analysis from @DaanCrypto:

-“Token founders are offering funds a kickback to bid coins on liquid market — particularly at token launch…” - important note on evolving TGE dynamics to be aware of from @cobie:

-MORPHO, PENGU, and POPCAT look to be listed on Coinbase soon:

-TL sentiment is still goblintown-adjacent, h/t @CryptoKoryo:

-Despite overall price action looking bleak, defi fundamentals are looking stronger and stronger, h/t @TheDeFinvestor:

-“Coinbase could be a $1T company” - interesting thoughts from @Matt_Hougan:

-Much excitement about official start of dTAO in Bittensor/$TAO land, h/t @BarrySilbert:

-Long-form market thoughts from @Awawat_Trades:

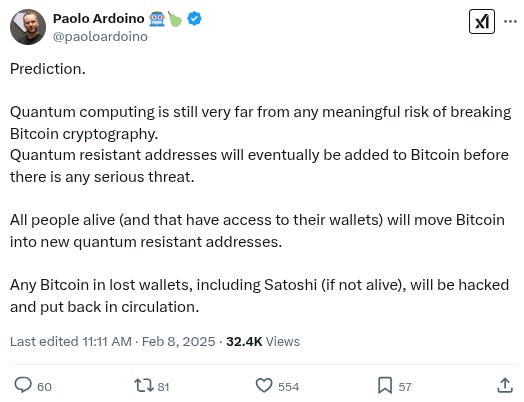

-“All people alive (and that have access to their wallets) will move Bitcoin into new quantum resistant addresses. Any Bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation.” - very interesting tweet from @paoloardoino:

-New weekly roll-up from @BanklessHQ featuring guest @MikeIppolito_:

-New roundtable from @0xSteadyLads:

-New episode of @theempirepod featuring @santiagoroel and @JasonYanowitz:

-New video on $TAO/Bittensor and the dTAO rollout from The Block Runner:

-Parting wisdom from @santiagoroel:

Conclusion

Have a great Saturday and don’t forget to touch some grass this weekend friends!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

The price action so far in February has been onerous, but the extreme volatility has provided the gigabrain logistical brilliance of @maplefinance a chance to shine…

As stated in their recent article:

“On February 2nd, crypto markets experienced their largest liquidation event in history, with over $10B in liquidations in a single day. ETH briefly wicked into the low $2,000s, and many digital assets fell 10–30%.

Despite the extreme volatility, Maple’s Blue Chip and High Yield Secured Lending products remained fully overcollateralized, with risk actively managed by our team in real time.

Unlike automated liquidations on DeFi money markets, Maple’s structured credit model allows for proactive risk management—loans are conservatively structured, margin calls are issued before collateral levels become critical, and liquidations are a last resort.

This approach enabled us to execute 15 margin calls across pools, all of which were resolved within hours. Borrowers either posted additional collateral or repaid loans early, ensuring zero liquidations across all pools.”

We are going to be banging the drum about everything Maple/Syrup are doing, so make sure to follow them on Twitter for more updates (accounts are @maplefinance and @syrupfi), and make sure to check out the exquisite $USDC yields they are currently providing as well (more info by clicking here)!!!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Monthly Sponsor @vertex_protocol are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.