Happy Thursday friends! Price action continues to look up!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.54T

QQQ (Nasdaq 100): $554.07

Gold: $3,317.95

Oil (WTI): $67.05

US 10Y Treasury: 4.368%

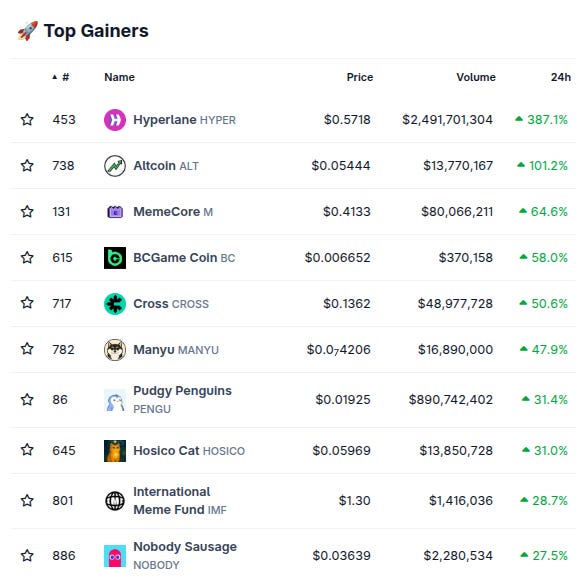

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Take note good frogs! The CATX IDO’s from @Catex_Fi are coming!

Catex is the MetaDEX for Uniswap v4, and comes from the team at @LynexFi on Linea who we have been helping bang the drum about over the last year!

As they state:

“Catex is here to be @Unichain’s Uniswap v4 home.

Built for hook innovation.

Driven by aligned incentives.

Launching with intent…”

They are launching at $10M FDV, with the raise spread across three leading launchpads and a native sale!

You can learn all the details in their full article on it by clicking here and in the thread below!

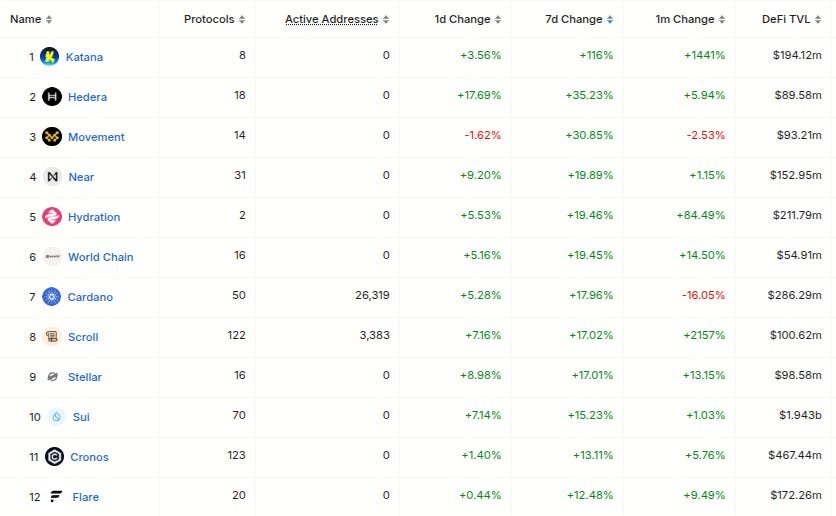

Biggest TVL Movers + Other Interesting Data

Chains are quite green today. Only top 50 chains red on all three timelines (daily, weekly, monthly) are Arbitrum (#7), Aptos (#12), and Blast (#47).

Protocols are also quite green today. Only top 50 protocols red on all three timelines (daily, weekly, monthly) are BlackRock’s BUIDL (#15), and Lombard Finance (#27).

Here’s The Top 12 Fastest-Growing Chains By TVL On The Weekly With At Least $50M TVL (from @DefiLlama):

Here’s The Top 12 Fastest-Growing Protocols By TVL On The Weekly With At Least $50M TVL (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Token-Holders’ Revenue (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-18.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-10.50% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-10.20% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-12.61% APY on USDS on Yearn h/t DefiLlama research

-11.81% APY on USDC on Stream Finance h/t DefiLlama research

-10.21% APY on SUSDE on Echelon Market (on Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

-7.91% APY on GHO on Aave V3 h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @Vestora_Finance. Twitter bio states “Decentralized Stock Exchange”. Followed by 3 of our mutuals. h/t @twindoges (make sure to give him a follow!):

-Something new called @pelagosnetwork. Twitter bio states “We build the execution layer for any blockchain use case, from defi to enterprise solutions. Any Language | Any VM | Any Chain”. Followed by 5 of our mutuals. h/t @twindoges:

-Something new called @suithetic. Twitter bio states “generates structured, verifiable synthetic data using LLMs, securely stores it on-chain, and provides a marketplace for high-quality dataset”. Followed by 3 of our mutuals. h/t @twindoges:

Important News And Analysis

-Bitcoin right at previous ATH’s and Ethereum was the top performing token in the top 10 yesterday, h/t @Tyler_Did_It:

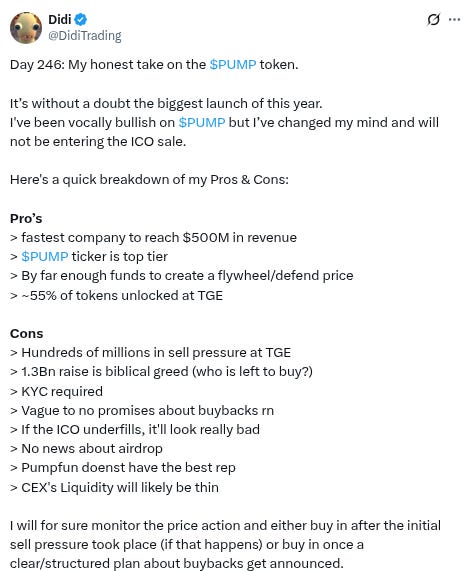

-The upcoming PumpFun ICO this weekend continues to generate massive debate, h/t some examples from @blknoiz06 and @DidiTrading:

-Three worst-performing narratives this month so far are SocialFi, ICM, and DeFAI, h/t @_dexuai:

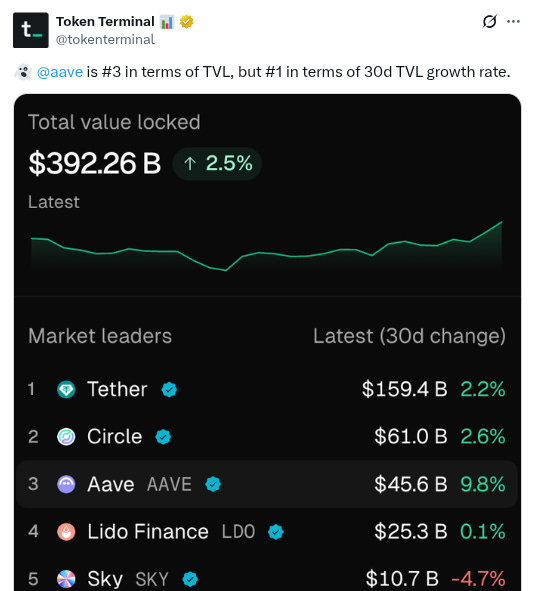

-Aave is less than $15B away from surpassing Circle (USDC) by TVL, h/t @tokenterminal:

-Worldcoin and Story ($IP) are apparently partnering, h/t Jeff Park @dgt10011:

-Continue to see bullish takes on $FLUID from smart accounts we follow, example from @alpha_pls below:

-Thread on some popular upcoming prospective Solana airdrops including Huma, Loopscale, Kyros, RateX, and Neutral Trade, from @TheDeFinvestor:

-Phantom Wallet now making $500k in revenue per day, h/t @tokenterminal:

-Interesting thoughts on why $SYRUP, $HYPE, and $EUL have been so successful this year, from @TraderNoah:

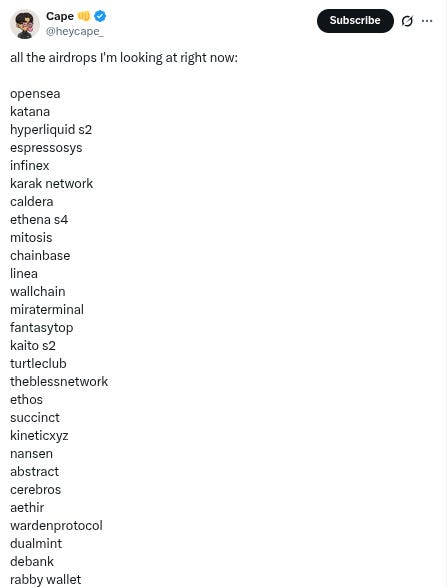

-Big but good airdrop list from @heycape_:

-Great article on the new Phantom x Hyperliquid integration from @GLC_Research (note: click to read in full, $HYPE-bulls in particular will enjoy):

-New roundtable discussion from @theempirepod (aired seven hours ago):

-New interview with macro commentator and Bitcoin-evangelist @LynAldenContact:

-New livestream from @Lightspeedpodhq (aired yesterday):

-New @coinbureau channel video on tokenized stocks, Solana, and more:

-New macro interview with Mike Green @profplum99:

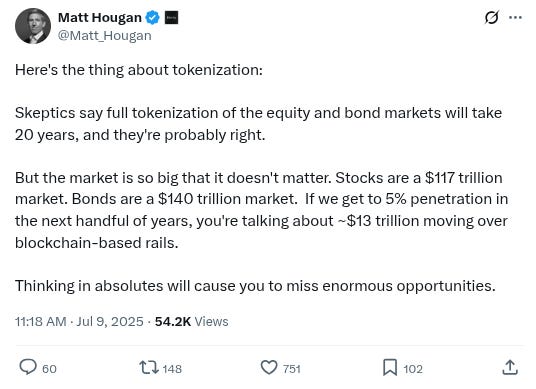

-Don’t miss out on the enormous opportunities in front of us good anons! Parting wisdom from @Matt_Hougan:

Conclusion

Happy Thursday friends! Enjoy the positive price action! :)

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.