Happy Tuesday friends! And Happy July! And Happy Q3!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.39T

QQQ (Nasdaq 100): $546.82

Gold: $3,3336.86

Oil (WTI): $65.65

US 10Y Treasury: 4.265%

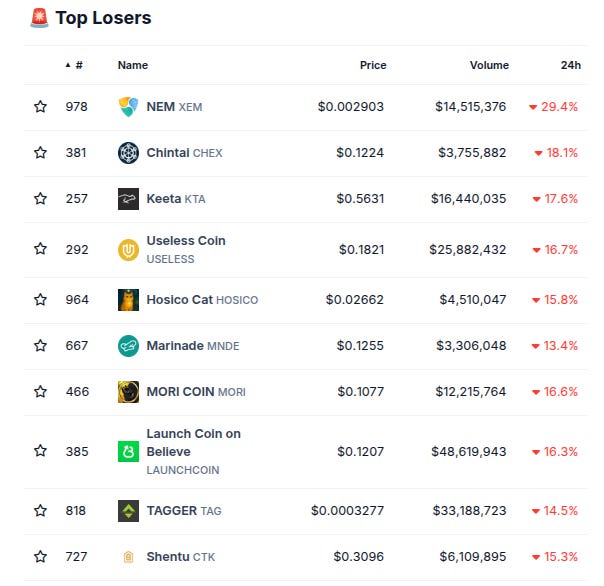

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Take note APY-enjoyers! Our Official Sponsor @upshift_fi currently has some of the best yields in all of defi!

-18.00% APY on their Injective USDT strategy (click here for a detailed explanation of the vault!)

-15.00% APY on $BTC via their Mezo tBTC vault

-10.50% APY in their Sylva concentrated liquidity vault

-Their extremely popular Hyperbeat Ultra HYPE Vault - one of the best possible ways to benefit from prospective airdrops in the HyperEVM ecosystem (via exposure to 5+ different projects!)

And many more! (visit their site to view all the available vaults now!)

They also continue to build alongside Pendle and Injective and Euler and numerous other great teams, so more exciting vaults are on the horizon!

In addition, deposits currently earn you a 5x bonus on Upshift Points (airdrop enthusiasts take note!) and you can also create an Upshift reflink to share with your friends to earn further points as well!

Make sure to follow them on Twitter for more updates, and check out Upshift co-founder @aya_kantor’s recent interview with @DeFi_Dad and @nomaticcap below!

Biggest TVL Movers + Other Interesting Data

Chains are mostly red today. Best-performing top 25 chain on the weekly is Hemi (#20) at +26.97%.

Protocols are mixed as well. Best-performing protocol on the weekly is Symbiotic (#33) at +17.22%.

Here’s The Top 12 Best-Performing Chains On The Weekly With At Least $1M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols On The Weekly With At Least $1M TVL: (from @DefiLlama):

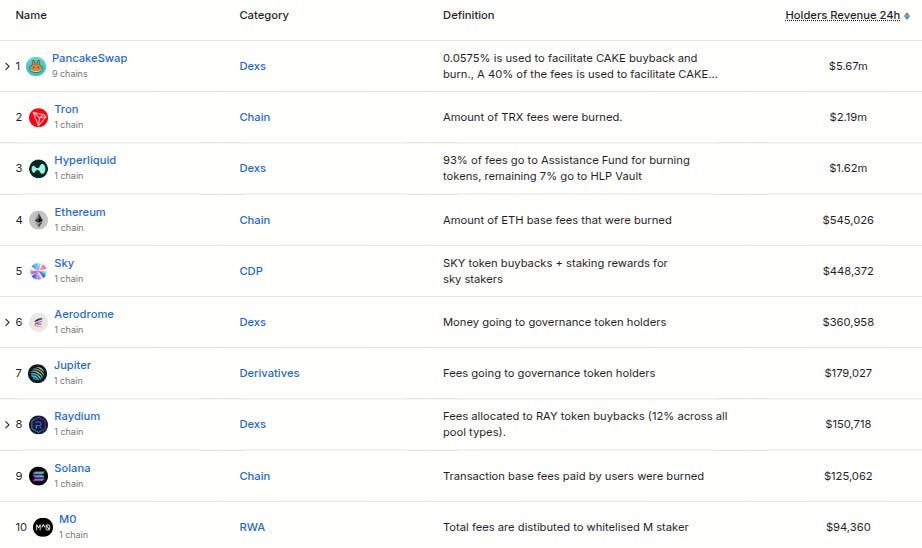

Here’s The Top 10 Entities By 24 Hour Token-Holders’ Revenue (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new/newish called @Aria_Protocol has been added to @DefiLlama, categorized as a RWA protocol on Story. Twitter bio states “The Future of IP Finance”. Followed by 29 of our mutuals.

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-$SOL-staking ETF goes live tomorrow (with $ETH-staking ETF’s expected to follow next), Robinhood’s announcements yesterday continue to dominate the TL, and well-known Solana advisor and CT-adjacent poaster Nikita Bier is joining Twitter/X as Head Of Product, h/t @Tyler_Did_It:

-The Robinhood tokenized stocks stuff continues to catalyze discussion. Very interesting example below from @0xngmi and @DeFi_Dad pointing out that 1) the tokenized private company stuff is an extremely significant advancement, and 2) while we’ve had tokenized stocks on-chain, there has never been lots of liquidity for them nor have we really begun to plumb the depths of what can be done in this regard:

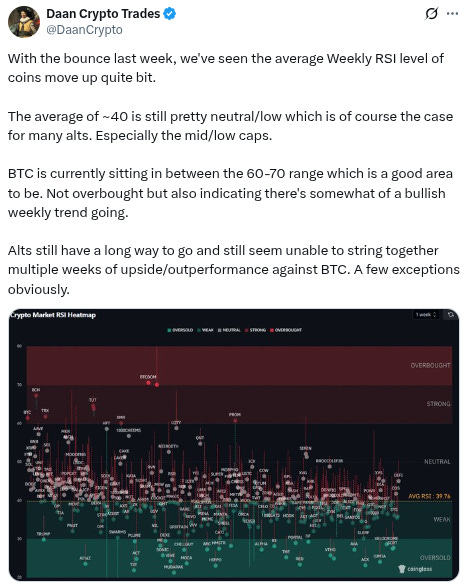

-RSI data still far from overheated (especially on alts), shows some good momentum for Bitcoin, h/t @DaanCrypto:

-Stocks have not had a red July in over a decade (though as per the data we included yesterday historic crypto returns in July have been a bit more muted), h/t @zerohedge:

-Could Twitter/X eventually integrate with Solana? (especially given the above-mentioned Nikita Bier news?), h/t @EffortCapital:

-Airdrop meta continuing to run strong, h/t @TheDeFinvestor:

-Macro liquidity situation looking bullish, h/t @LDNCryptoClub:

-The Altcoin Season Index is still extremely low (again, around 15-20 depending on how you measure it) but a few select alts have been outperforming, primarily within the defi and memecoin sectors. h/t good summary of last two weeks from @thedefivillain:

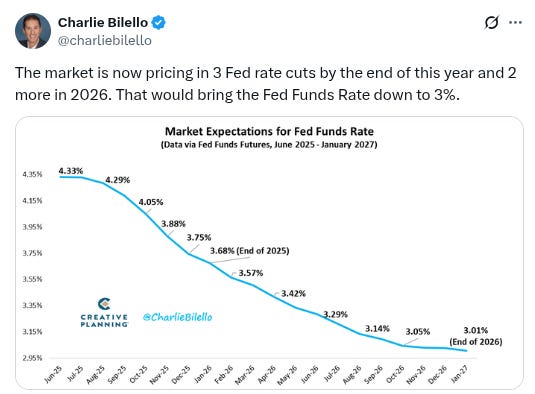

-Market currently pricing in three Fed rate cuts over the rest of this year, h/t @charliebilello:

-Have seen several smart folks we follow talking about Fluid’s work on a perps product, example below from @troyharris_:

-Are stablecoins the main vehicle through which the next big leg of currency debasement will take place? h/t @fejau_inc:

-New interview with Uniswap founder Hayden Adams:

-Three @BanklessHQ interviews from Cannes yesterday, including with Robinhood’s Vlad Tenev:

-New roundtable from @Unchained_pod:

-New livestream from @docXBT (aired yesterday):

-New interview with @hosseeb from @therollupco:

-“Fiscal printing + easy monetary policy = denominator is pretty worthless (long risk) Don't miss the forest for the trees overtrading or getting liqd on leverage” - great parting overview of the macro picture from @apewoodx:

Conclusion

Happy Tuesday and Happy July friends! Here’s to a big Q3!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

The team at @maplefinance enters Q3 having one of the biggest comeback arcs of the year and as one of the most celebrated teams in defi!

Things are just getting started, however, and the rest of this year is shaping up to be even more bullish!

Here are some great resources if you want to get caught up on everything they are up to:

-A massive thread of research from the gents at @GLC_Research (click here to read in full)

-New interview Maple co-founder @syrupsid did with @ayyyeandy from The Roll Up (link here)

-Interview from last month that @syrupsid did with @leviathan_news (link here)

-Interview that Maple co-founder @joe_defi did recently with @AleaResearch (link here)

-And, finally, the excellent interview @syrupsid recently did with @fejau_inc from Forward Guidance that is embedded below!

And as always make sure to follow them on Twitter for more updates, and stay tuned as we continue banging the drum about everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.