Happy Thursday good degens! Things are looking insanely bullish but we are still beneath ATH’s!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.46T

QQQ (Nasdaq 100): $556.98

Gold: $3,327.64

Oil (WTI): $66.74

US 10Y Treasury: 4.326%

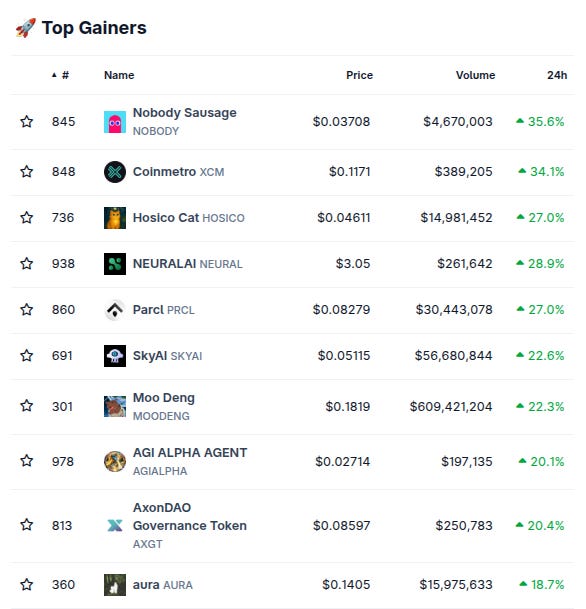

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

GammaSwap Summer is here friends!!!

“GammaSwap Summer is a three month period of increased incentives for the protocol to scale out the new Yield Token product — composable vault tokens that provide liquidity into Concentrated Liquidity AMMs (CLAMMs) and use GammaPools to hedge Impermanent Loss (IL).

There will be two types of incentives during GammaSwap Summer: esGS Liquidity Mining for GammaPools and points for Yield Tokens…”

The above just started a couple days ago and will continue until September, so make sure to visit the GammaSwap site now to get started!

And once again take note that the Yield Token tech itself is going to radically advance the world of dex’s and on-chain liquidity and become an extremely important new defi lego!

So make sure learn more via the full article on it and the thread below, follow GammaSwap on Twitter for more updates, and stay tuned as we continue banging the drum about everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are quite green today. Only top 25 chains red on the weekly are Base (#6), Berachain (#14), and Sonic (#16).

Protocols are also quite green today. Only top 25 protocols red on the weekly are Pendle (#11), and BlackRock BUIDL (#15).

Here’s The Top 12 Best-Performing Chains On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-18.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-10.50% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-10.20% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-11.84% APY on USDS on Yearn h/t DefiLlama research

-11.00% APY on USDC on Stream Finance h/t DefiLlama research

-10.07% APY on SUSDE on Echelon Market (on Aptos) h/t DefiLlama research

-9.03% APY on USDC on Goldfinch h/t DefiLlama research

-8.13% APY on GHO on Aave V3 h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @wastedotbet. Twitter bio states “A fine place to lose money on-chain.” Followed by 3 of our mutuals. h/t @AresLabs_xyz:

-Something new/newish called @arch_swap has been added to @DefiLlama, categorized as a dex on Botanix. Twitter bio states “The only native DEX purpose-built for @BotanixLabs 🕷️ Deeper liquidity, efficient incentives and lower fees.” Followed by 10 of our mutuals.

Important News And Analysis

-The Coinbase acquisition of Liquifi and the Solana staking ETF going live are still the dominant stories today, h/t @Tyler_Did_It:

-Total crypto market cap still over 10% below its ATH of $3.9T, without much froth apart from the ever-fascinating variable that is treasury companies, h/t @DaanCrypto:

-Commercial real estate crisis in the US continues to worsen (particularly with office buildings), h/t @KobeissiLetter:

-Continued speculation that Trump may attempt to fire Jerome Powell:

-Tom Lee continues to generate attention with his IRL bull-poasting re: Ethereum, increasingly labeling it “the stablecoin chain”, h/t @chainyoda:

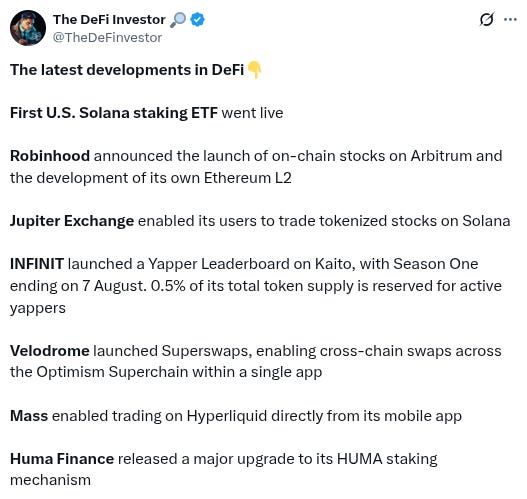

-Jupiter and Velodrome and other defi protocols all generating attention, h/t news from @TheDeFinvestor:

-Is $BNB a good long right now? h/t @crypto_condom:

-@Lighter_xyz continues to be one of the most popular airdrop opportunities, good in-depth analysis from @arndxt_xo below:

-Is the perps-meets-tradfi phenomenon going to be vastly more significant than anyone realizes? h/t @poopmandefi:

-More HyperEVM farming alfa from @NPC_68 including @felixprotocol and @HypurrFi:

-New Arthur Hayes @CryptoHayes article on stablecoins as vehicle for debasement and Bitcoin + the stock market being set to shoot far higher, read in full here and see screenshot below:

-New @BanklessHQ video featuring @EffortCapital and @TheOneandOmsy having a debate about Coinbase/$COIN vs Robinhood/$HOOD:

-New roundtable discussion from @Unchained_pod:

-New update on the US multifamily real estate market from George Gammon and Ken McElroy:

-Parting wisdom from @ChillTRD c/o @QuotableCrypto:

Conclusion

Happy Thursday friends! Enjoy the positive price action!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.