Happy Monday friends! Start of another big week!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

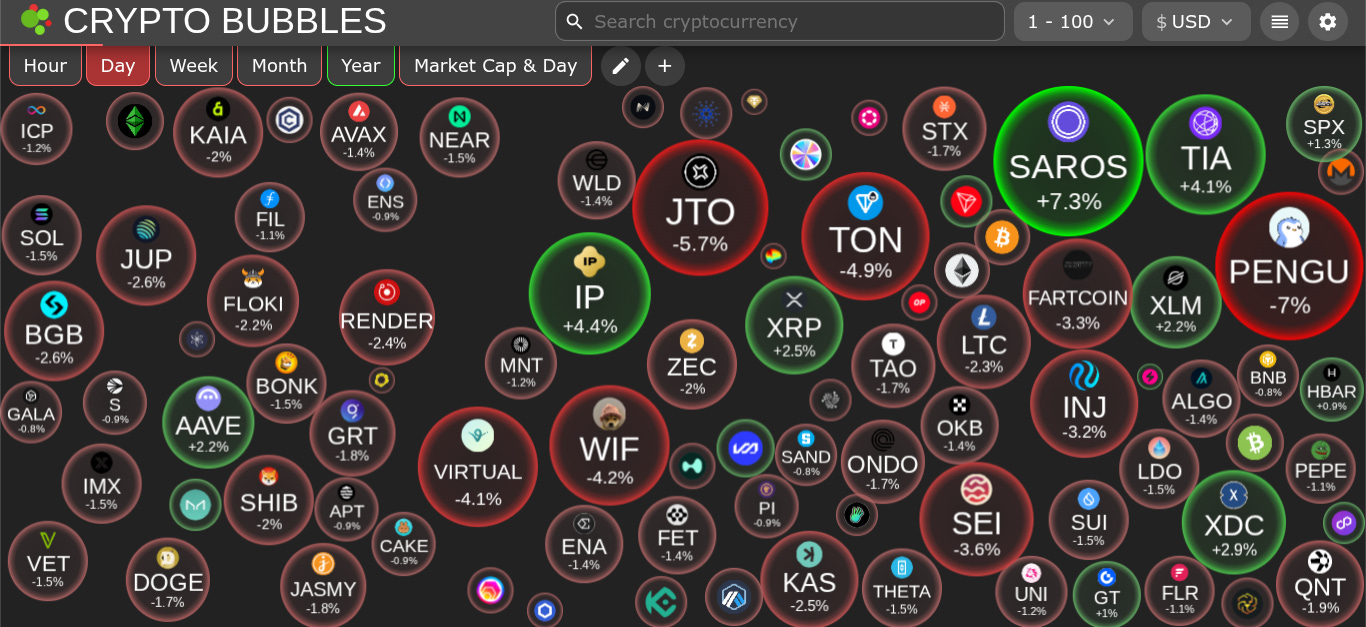

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.42T

QQQ (Nasdaq 100): $552.48

Gold: $3,331.66

Oil (WTI): $67.51

US 10Y Treasury: 4.383%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Take note good degens! @maplefinance has surpassed BlackRock’s BUIDL fund in AUM/TVL - which means they are now the world’s largest on-chain asset manager!

This is just the latest W for the Maple team, who have engineered one of the biggest comebacks in all of crypto since the depths of the last bear market, and represent one of the biggest defi success stories of 2025!

They also just hit new ATH’s in monthly revenue, have announced all sorts of new integrations and partnerships, and have some extremely hearty $syrupUSDC yields available!

Learn more about all of the above in this great thread from @GLC_Research, follow Maple on Twitter for more updates, and learn more about the history of the project in the interview with co-founder @syrupsid from Forward Guidance embedded beneath the tweet below!

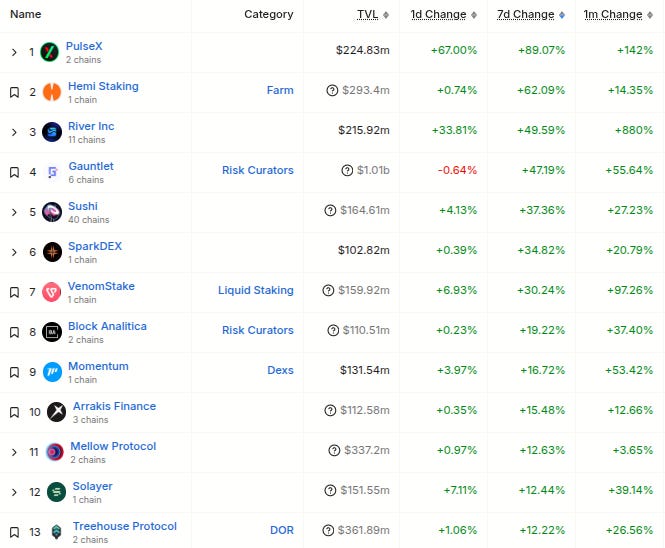

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Only top 25 chains red on all three timelines (daily, weekly, monthly) are Aptos (#12), Berachain (#14), Sonic (#16), and OP Mainnet (#22).

Protocols are also mixed today. Only top 25 protocols red on all three timelines (daily, weekly, monthly) are EtherFi (#5), and BlackRock BUIDL (#15).

Here’s The Top 12 Best-Performing Chains On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Revenue Generation (from @DefiLlama):

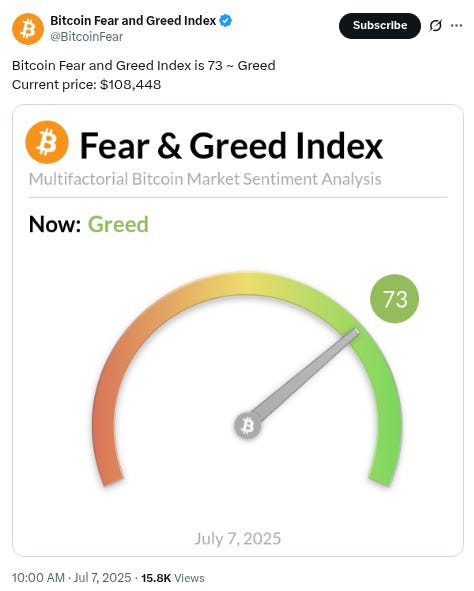

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-18.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-10.50% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-10.20% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-12.61% APY on USDS on Yearn h/t DefiLlama research

-11.81% APY on USDC on Stream Finance h/t DefiLlama research

-10.21% APY on SUSDE on Echelon Market (on Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

-7.91% APY on GHO on Aave V3 h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @eidolabs. Twitter bio states “Agentic swarm making defi easy…” Followed by 25 of our mutuals. h/t @larploki:

-Something new called @ShuffleUSA. Twitter bio states “America’s New Favorite Social Casino… Coming Soon. 18+ | No Purchase Necessary 🇺🇸” Followed by 6 of our mutuals. h/t @AresLabs_xyz:

-Something new called @unlink_xyz. Twitter bio states “One-click privacy for every blockchain transaction”. Followed by 2 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

-Bitcoin is still hovering a few hundred bps below previous ATH, $ETH is still in mid $2000’s, and BonkFun flipping PumpFun in memecoin launchpad market share is still biggest story from the trenches, h/t @Tyler_Did_It:

-Quiet week in macro, with next FOMC Meeting (Fed interest rate decision) not coming until July 29th, h/t @KobeissiLetter:

-There appears to be quite a speculative frenzy around stablecoins occuring in South Korea right now (is this a harbinger of a broader bull market globally?), h/t @100y_eth:

-Are RWA, Defi, and BTCfi the most investable altcoin niches for the rest of 2025? h/t @DaanCrypto:

-Eyes on bonds today in macro-land, h/t @crypto_condom and @conksresearch:

-More and more talk on the TL about this ETH x Tradfi narrative and its implications, example from @econoar below:

-@truflation’s real-time inflation metric has fallen to 1.75%:

-Good potential alfa from @kenodnb for our readers who are Kaito-enthusiasts, that it is apparently far easier to earn Yaps on the weekend:

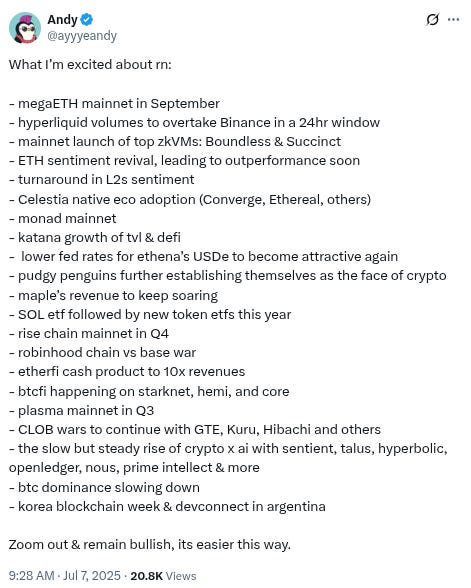

-Lots of stuff on the horizon to be excited about, h/t @ayyyeandy:

-Are @Lombard_Finance and @MitosisOrg the best Kaito pre-TGE projects to Yap about? Interesting new tier list of Kaito pre-TGE projects from @DidiTrading:

-Absolutely fantastic article from @sovereignsignal on the arrival of institutional money catalyzing some existential questions within the crypto world, and the arrival of AI doing the same generally, and what conclusions we can make regarding each (click here to read mini-thread version and get link to full article):

-New livestream from @DaanCrypto of TA and general market analysis:

-New crypto/macro livestream from @noahseidman:

-New livestream from the @coinbureau channel (aired two hours ago):

-New episode of Forward Guidance:

-New macro video from @AndreasSteno and @RosenvoldGeo:

-"…what’s really risky to me is working some dogshit job for 40 years and planning to “live life” after that. You don’t have to YOLO everything on risky investments, but not having any exposure to risk is intentionally choosing a lifetime of servitude.…." - parting wisdom from @redphonecrypto (click to read full article in entirety):

Conclusion

Happy Monday friends! Here’s to a big week!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.