Happy Wednesday friends! Good to see some greenery on the board today!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.46T

QQQ (Nasdaq 100): $554.13

Gold: $3,308.60

Oil (WTI): $68.71

US 10Y Treasury: 4.37%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Season Two is here for our Official Sponsor @upshift_fi with defi-lego composability for their yield-maxxing vaults and all sorts of accompanying opportunities!

As stated in the thread below:

“Upshift vaults are unique because they let users access the top-performing strategies used by DeFi hedge funds…

The next step is tokenizing each vault and making them composable across protocols like Pendle, Euler, Morpho and more...

You are still early. Our vision is to maximize the return of every asset onchain. Every high yield source will be tokenized on Upshift.”

Season Two will provide 10x Upshift Points for upUSDC on @pendle_fi and 5x Upshift Points for vault depositors!

AND… there are special ‘Tasks’ that will let you earn even more Upshift points, including the very first such opportunity in the tweet below!

Make sure to follow Upshift on Twitter for more updates, and stay tuned as we continue to shine a light on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are mostly green today. Best-performing chains on the weekly with at least $50M TVL are Goat, Movement, and Hemi.

Protocols are also mostly green today. Best-performing protocols on the weekly with at least $50M TVL are uncategorized Sui protocol Bucket Protocol, multichain EVM derivatives protocol edgeX, and PulseChain’s PulseX.

Here’s The Top 12 Chains By TVL: (from @DefiLlama):

Here’s The Top 12 Protocols By TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @Hyperwavefi has been added to @DefiLlama, categorized as a yield protocol on Hyperliquid L1 and Arbitrum. Twitter bio states “Building the Hyperliquid DeFi SuperApp, starting with hwHLP”. Followed by 37 of our mutuals.

-Something new called @usd_hl has been added to @DefiLlama. Twitter bio states “Earn more with USDhl. Bring value back to Hyperliquid. Built by @felixprotocol.” Followed by 152 of our mutuals.

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Robinhood CEO Vlad Tenev continues to double down on tokenization and tokenized stocks, Phantom wallet adds Hyperliquid-fueled perps functionality, and Coinbase continues unveiling new crypto infra, h/t @Tyler_Did_It:

-@pumpdotfun has announced its much-anticipated ICO will take place this Saturday, July 12th:

-Summary of the PumpFun tokenomics from @Tyler_Did_It:

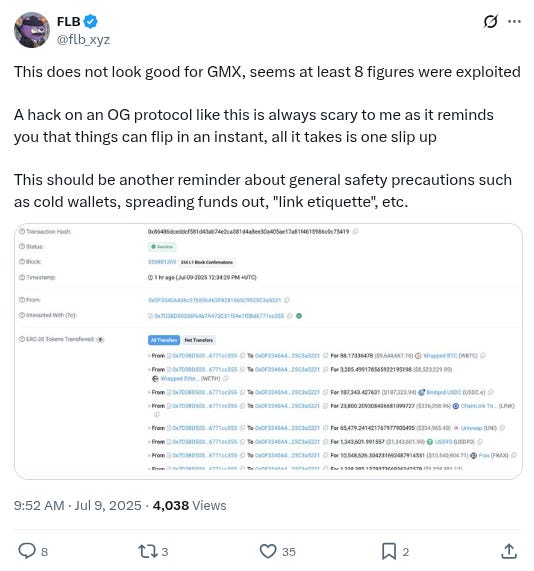

-GMX has apparently been exploited this morning, h/t @flb_xyz with important reminder to be hypervigilant re: security best-practices, and @0xWenMoon with more info on it:

-Vertex Protocol has been acquired by Kraken to serve as the perps dex infra for its L2 Ink, all existing instances of Vertex will be sunsetted, and VRTX-holders as of a snapshot yesterday will receive 1% of the INK token supply as terms of the buyout (note: regular readers will know that Vertex is the former Official Sponsor of The Daily Degen and we have continued helping them with education/amplification, however this was complete news to us too when it hit the TL yesterday), h/t @leviathan_news:

-Euler continues its comeback arc, h/t @tokenterminal:

-@tradeparadex getting more and more popular among airdrop-enthusiasts, h/t @NPC_68:

-Is crypto VC investing evolving into a barbell paradigm of boring infra on one side and total degeneracy on the other? h/t @ayyyeandy:

-Good overview of the current macro ‘debasement zeitgeist’ from @Tyler_Neville_:

-“we're returning to the default state: most humans working for themselves… maybe employment was the historical anomaly?” - interesting thoughts from @gregisenberg:

-Are more people souring on crypto VC investing? Interesting clip of @notthreadguy:

-(Related)… “total capital raised in Q2 fell 20% QoQ to $5B..” with Coinbase Ventures being the most active investor in Q2 - from great thread by @immutablejacob (below tweet is just one part, click to read in full):

-New episode of Forward Guidance with @RaoulGMI and @BittelJulien:

-New roundtable from @Unchained_pod:

-New @menlobear interview with macro gigabrain Doomberg:

-New @coinbureau video on the nascent crypto bull market going on in South Korea:

-New macro interview with @LukeGromen:

-Don’t give up good anons! Parting wisdom from @TheDeFinvestor via @QuotableCrypto:

Conclusion

Happy Wednesday friends! Stay alert out there!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

The absolute gigachads at Maple Finance surpassed BlackRock’s BUIDL fund in AUM/TVL - which means they are now the world’s largest on-chain asset manager!

They also just hit new ATH’s in monthly revenue, have announced all sorts of new integrations and partnerships, and have some extremely hearty $syrupUSDC yields available!

Learn more about all of the above in this great thread from @GLC_Research, follow Maple on Twitter for more updates, and learn more about the history of the project in the interview with co-founder @syrupsid from @therollupco embedded beneath the tweet below!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.