Happy Friday good degens! The excitement continues!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.35T

QQQ (Nasdaq 100): $525.39

Gold: $3,368.17

Oil (WTI): $75.30

US 10Y Treasury: 4.405%

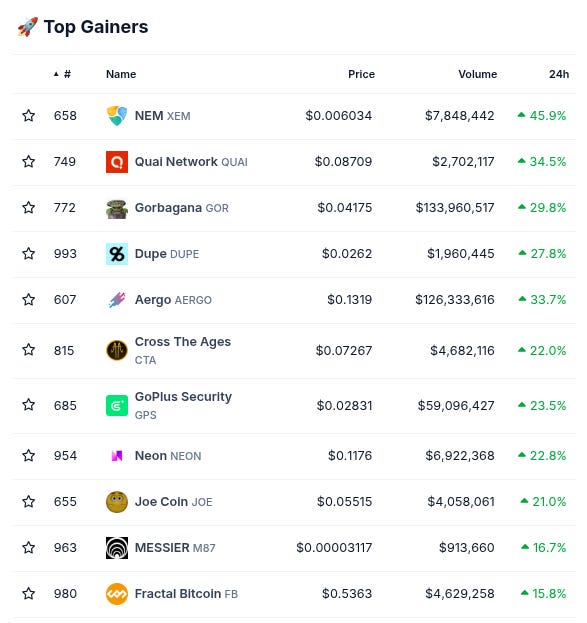

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

The bullish news keeps stacking up for our Official Sponsor @upshift_fi!

-Their Hyperbeat Ultra HYPE Vault (one of the best possible ways to get exposure to the HyperEVM ecosystem and its prospective airdrops right now!) has surpassed $55M TVL…

-They just rolled out a mega-bullish new integration with HyperEVM’s @Okto_wallet…

-They recently surged past $330M in TVL overall…

-They continue to build alongside Pendle and Injective and Euler and numerous other great teams…

-And they are generating all sorts of excitement among some of the most well-sophisticated and respected defi’ers in crypto!

Visit the Upshift site to get started, make sure to follow them on Twitter for more updates, and check out Upshift co-founder @aya_kantor’s recent interview with @DeFi_Dad and @nomaticcap below!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Top 25 chains green on all three timelines (daily, weekly, monthly) include BSquared (#18), and Hemi (#22).

Protocols are also mixed today. Top 25 protocols green on all three timelines (daily, weekly, monthly) include EigenLayer (#3), Binanced Staked ETH (#5), and Morpho (#12).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

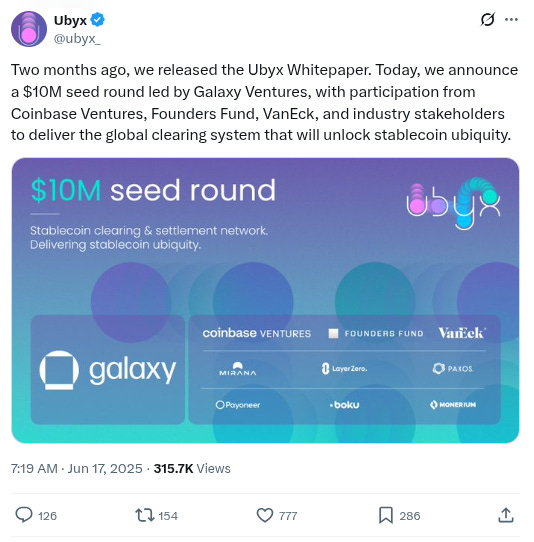

-Something new called @ubyx_. Twitter bio states “The global clearing and settlement network for stablecoins”. Followed by 41 of our mutuals. h/t @AresLabs_xyz:

-New project called @UV_Money. Twitter bio states “The future of money, beyond the visible. Launching soon - built on @infraredfinance”. Followed by 12 of our mutuals. h/t @AresLabs_xyz:

-Something new called @0xorbSwap. Twitter bio states “Swap between 1,000 different stablecoins with minuscule slippage. Every stablecoin, every chain, one orbital.” Followed by 10 of our mutuals. h/t @AresLabs_xyz:

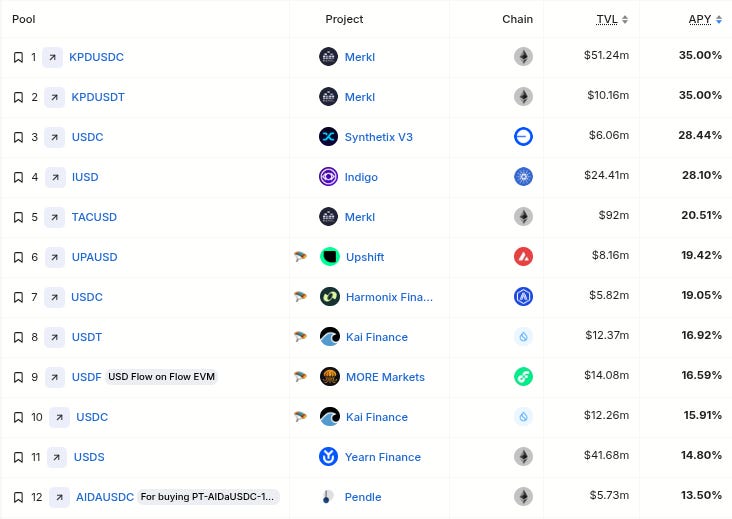

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $5M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Crypto stocks continuing to rise, while $BTC hovers above 100k but below recent ATH’s, h/t @Tyler_Did_It:

-Increasingly dovish statements from Fed’s Chris Waller are generating attention, as he is considered by many to be one of the top candidates Trump is looking at to replace Powell:

-Will Circle’s massive surge in stock price cause stablecoin-related tokens like Ethena to be revalued higher? h/t @litocoen:

-Related ruminations re: Spark airdrop from @CloutedMind and @pythianism:

-Airdrop alfa on @TradeNeutral from @MingoAirdrop:

-Interesting observation from @alpha_pls that MegaETH now has a 91% bullish rating on @ethos_network while Monad only has a 17% bullish rating:

-Interesting update from @DidiTrading on his airdrop earnings so far this year (just over 30k, with 1/3 of that coming from Kaito-related stuff):

-Fascinating chart from @KobeissiLetter that US household allocation to stocks is at 43.1%, up from a recent low of 19% in 2010, which was down from a high of 39% in 2000 (note: we think the idea that this suggests a ‘bubble’ in stocks is a bit of a mid take, and it rather reflects something more akin to unofficial regime diktat and a giant stack of layered incentives and the fact that a perpetually surging stock market is now a key foundational pillar of the entire modern US economic system, which is unsustainable without perpetually-rising asset prices):

-Is the Hyperliquid ethos starting to rub off on other projects? h/t @defi_monk:

-Interesting stat from @NPC_68 that despite Tether’s significance, it is still only the 19th largest holder of US treasuries, and stablecoins still have massive room to grow:

-New Q&A with macro gigabrain @LukeGromen:

-New Pomp interview with Tether’s @PaoloArdoino:

-New edition of @thebellcurvepod:

-New interview with macro gigabrain Doomberg:

-New episode of @theempirepod:

-“Everything I used to dream about for crypto is happening…” - parting sentiments from @redphonecrypto:

Conclusion

Happy Friday and stay alert out there friends!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

Take note tradoors! Trading Rewards on Avalanche and Sei have been extended for @vertex_protocol users!

Learn more about how to take advantage of these rewards via the tweet below or the Vertex docs by clicking here!

Avalanche and Sei are two of the main chains that Vertex powers perps-trading on, but their current goal is to reach 25+ different EVM chains!

The next one up is Katana: “A defi chain forged to bring dead bags to life via deep liquidity & high yield built by katana foundation, incubated by @0xpolygon x @gsr_io…”

Visit the Vertex site now to get started trading 60+ perps and spot markets, and stay tuned as we continue shining a light on everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.