Happy Monday friends! Start of another big week!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.20T

QQQ (Nasdaq 100): $528.71

Gold: $3,381.81

Oil (WTI): $71.42

US 10Y Treasury: 4.316%

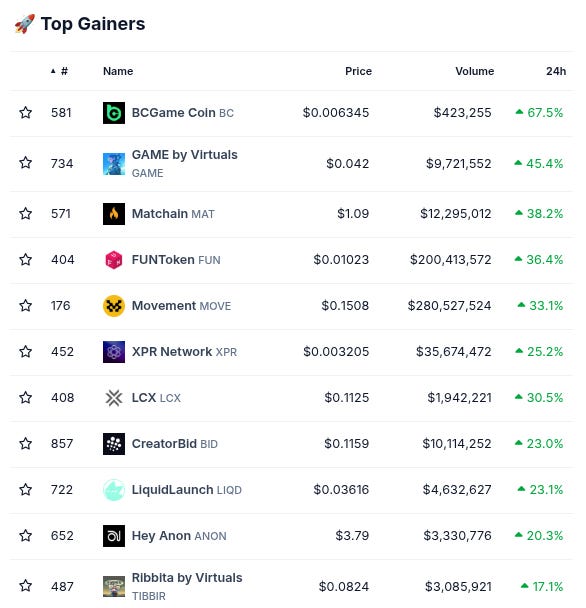

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

The abject gigachads at @maplefinance! continue to rack up W after W this year!

-They just hit $2B in TVL/AUM! (an absolutely explosive journey from under $500M just several months ago…)

-They just expanded $syrupUSDC to Solana! (check out @KaminoFinance for some insanely high yields on it!)

-They announced a massive new partnership with legendary tradfi firm Cantor!

-And they continue to build with @sparkdotfi, with @pendle_fi, and countless more of the most well-respected teams in defi!

Make sure to follow them on Twitter for more updates, and check out Maple co-founder @syrupsid’s recent interview with @therollupco to get a closer look at everything they are working on!

Biggest TVL Movers + Other Interesting Data

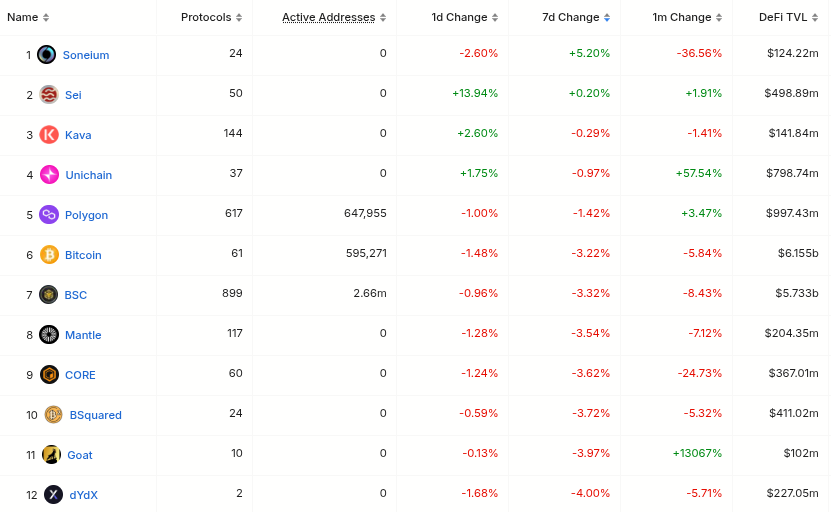

Chains are mixed today. Biggest gainer on the monthly among top 10 chains is Hyperliquid L1 (#8) at +29.39%.

Protocols are also mixed today. Biggest gainer on the monthly among top 25 protocols is Veda (#13) at +27.78%.

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $100M TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-25.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-11.60% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-14.06% APY on USDS on Yearn h/t DefiLlama research

-11.35% APY on USDC on Stream Finance h/t DefiLlama research

-10.07% APY on XUSDC on Multipli(dot)fi h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

-8.73% APY on GHO on Aave V3 h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @slant_ai. Twitter bio states “the intelligence engine of solana”. Followed by 9 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

-Circle’s stock has surged so much than its market cap is now greater than the total TVL or circulating market cap of $USDC… and we are seeing even some of the most die-hard crypto bulls on Twitter talking about buying puts on it… while others are talking about how much projects like Aave would be worth if valued similarly (Aave has over $40B in TVL and has a market cap less than 1/10th of that), h/t @0xMughal:

-Anthony Pompliano’s new $BTC treasury company ProCap Financial is generating headlines today, and we saw similar headlines about $HYPE-focused and $BNB-focused treasury companies over the last two days as well, as the new treasury company meta continues to heat up, h/t @Tyler_Did_It:

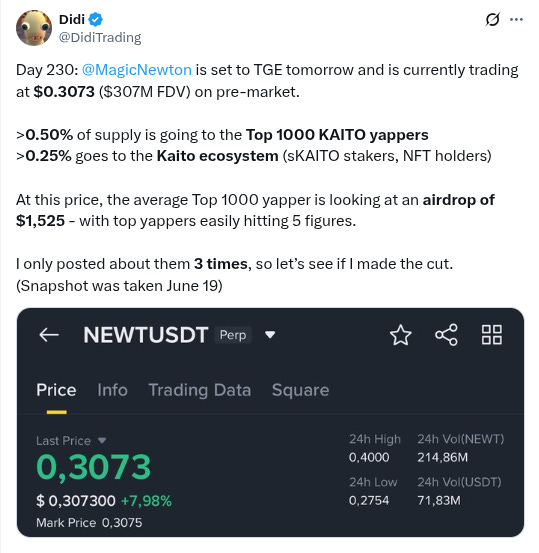

-@MagicNewton TGE coming tomorrow, with Yappers looking to receive a decent airdrop, h/t @DidiTrading:

-Is LP’ing on Uniswap once again becoming lucrative? h/t @Cryptoyieldinfo:

-Important security alert re: Trezor and fake phishing emails, h/t @WuBlockchain:

-Another typically more hawkish Fed member signals support for cuts, as the Powell vs Trump tension ramps higher and higher, and speculation continues on who Trump will choose as Powell’s replacement, h/t @zerohedge:

-Is Arbitrum a Kaito campaign worth Yapping about? h/t @MingoAirdrop:

-‘Distribution’ increasingly king as social media eats more and more of the global economy, h/t @sandraaleow:

-Is the launch of Tesla’s Robotaxi the beginning of a “post-driving civilization”? Seeing lots of posts like this today, example c/o @signulll:

-$SPK generating a lot of attention on the TL the last few days, example below from @hmalviya9:

-Is Polymarket one of the best current airdrop opportunities? h/t @DidiTrading:

-New @coinbureau livestream (aired two hours ago):

-New macro livestream from @AndreasSteno and @RosenvoldGeo (aired two hours ago):

-New @JasonYanowitz interview with the leaders of Polygon:

-New @DaanCrypto livestream from this morning, of TA and general market analysis:

-New interview with Tether’s Paolo Ardoino from The Block:

-“Many of the top DeFi projects were born during brutal market conditions. Hyperliquid, Uniswap, and Curve Finance are just a few examples. Pay attention to the teams that keep shipping regardless of market direction…” - parting wisdom from @TheDeFinvestor:

Conclusion

Happy Monday friends! Here’s to a big week!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.