Happy Friday good degens!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.40T

QQQ (Nasdaq 100): $546.22

Gold: $3,285.87

Oil (WTI): $65.43

US 10Y Treasury: 4.267%

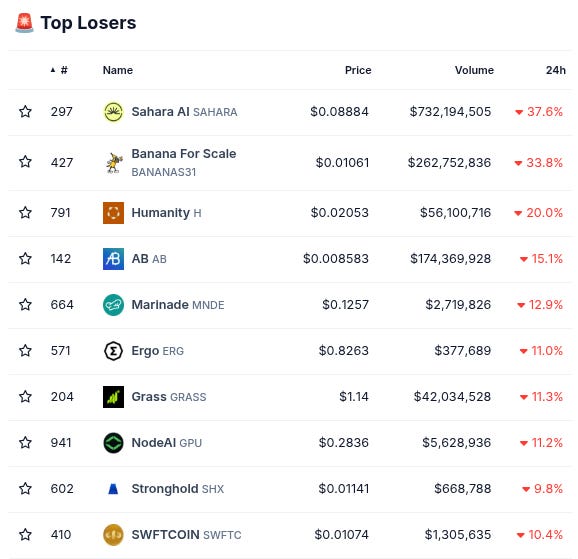

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

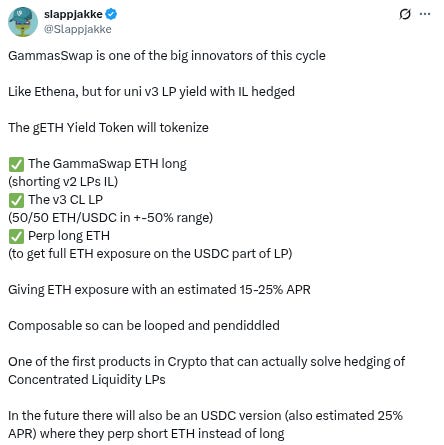

Take note! The new “Yield Token” tech from @GammaSwapLabs is almost ready for release!

Excitement is reaching a fever pitch, and it seems clear at this point that yield tokens will be one the most consequential new defi primitives of the year!

“Hedge IL automatically…”

“Receive a spot-like token that accrues yield over time…”

“Yield tokens take the highest yield by category product (CLAMMs) and derisk it by hedging the IL automatically. Users retain replicated spot exposure with market leading yields. DEXs scale to new heights. Liquidity becomes composable again…”

This is going to radically advance the world of dex’s and on-chain liquidity and become an extremely important new defi lego, and we are hugely excited to be banging the drum about it, so make sure to click here to learn more now, and follow GammaSwap on Twitter for more updates, AND… check out the tweet on the subject from @Slappjakke below!

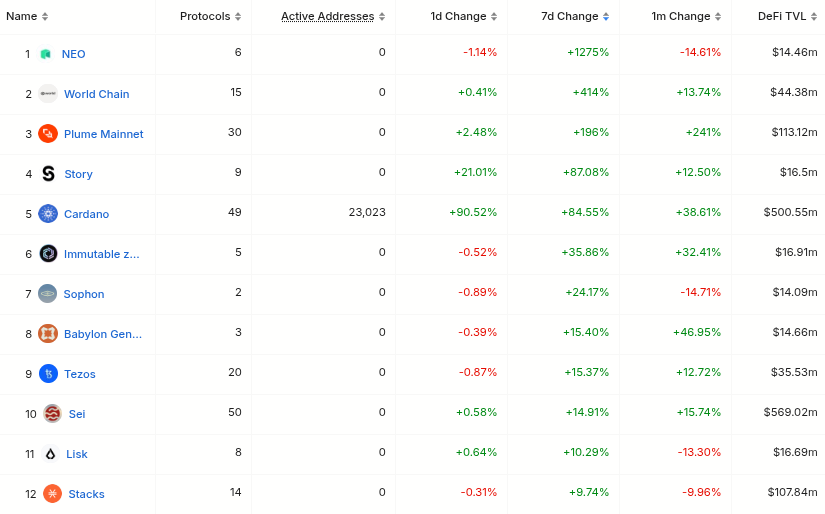

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Best-performing top 50 chain on the monthly is Plume Mainnet (#38) at +241%, with notable runner-up Hydration (#39) at +132%.

Protocols are also mixed today. Best-performing top 50 protocol on the monthly is Euler DAO (#37) at +52.11%.

Here’s The Top 12 Best-Performing Chains On The Weekly With At Least $10M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols On The Weekly With At Least $10M TVL: (from @DefiLlama):

Here’s The Top 10 Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-25.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-11.60% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-14.06% APY on USDS on Yearn h/t DefiLlama research

-11.35% APY on USDC on Stream Finance h/t DefiLlama research

-10.07% APY on XUSDC on Multipli(dot)fi h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

-8.73% APY on GHO on Aave V3 h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @grovedotfinance. Twitter bio states “Learn more at grove[dot]finance…” Followed by 29 of our mutuals. h/t @twindoges (make sure to give him a follow!):

-Something new called @matchametaxyz. Twitter bio states “Building the best and most transparent meta-aggregator. Execution quality is king 👑 Private beta now. Public beta soon.” Followed by 10 of our mutuals. h/t @twindoges:

-New project called @RoarFinance. Twitter bio states “Innovative Yield Engine powered by @HyperliquidX”. Followed by 2 of our mutuals. h/t @twindoges:

-New project called @askjuneai. Twitter bio states “Your data, your AI. Coming soon...” Followed by 5 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

-With Circle having had its notorious price surge and Coinbase/$COIN now close to $400 per share, will Ethereum finally pump next? h/t @iamDCinvestor:

-Still widespread pain across the altcoin landscape, h/t @LouisCooper_:

-Chris Waller is currently leading candidate on Polymarket to be Trump’s replacement for Jerome Powell, followed closely by Kevin Warsh, with Kevin Hassett and Scott Bessent himself in third and fourth place:

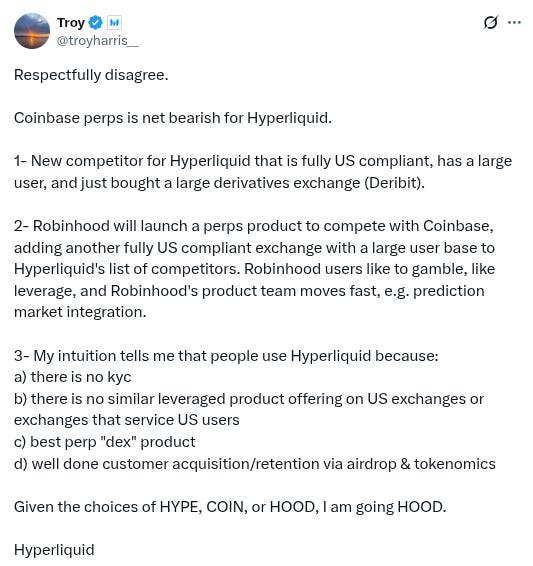

-Coinbase will officially be rolling out perps trading for US customers on July 21st:

-Lot of talk on the TL about whether the above Coinbase US perps news is bullish or bearish for Hyperliquid. Here is a bull case from @defi_monk:

-And the bear case from @troyharris_ (quote-tweeting the above):

-With memecoins having fully rotated out of the mindshare center, is this a good time to start re-allocating into them? h/t @TheDeFinvestor:

-Is macro liquidity situation looking brighter? h/t @AndreasSteno:

-Remember to check your Sahara and Fragmetric airdrop eligibility, h/t @flb_xyz:

-Is $VIRTUAL cooked or poised for a revenge rally? h/t @thedefivillain:

-Current inflation data from @truflation:

-New interview with @LynAldenContact from our friend @pahueg:

-New roundtable from @Unchained_pod:

-New Doomberg interview for our macro friends:

-5+ hour long livestream from Permissionless yesterday from @therollupco:

-Parting bullishness from @CloutedMind:

Conclusion

Have a great Friday and stay alert out there friends!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.