Happy Saturday friends! Quite a week we’ve witnessed!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.41T

QQQ (Nasdaq 100): $529.92

Gold: $3,307.37

Oil (WTI): $64.58

US 10Y Treasury: 4.506%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Take note good degens! @Darius_Tabai- co-founder of @vertex_protocol- recently did a new interview with @SynopsisEvents!

In it he discussed everything Vertex is working on as well as his thoughts on the world of crypto in general…

It is a good introduction to all the extremely bullish stuff going on with Vertex… such as the insanely high yields they are currently providing to $VRTX-stakers and $USDC-lenders, their gigabrain omnichain liquidity system Vertex Edge (which is currently ranked #5 overall among all perps providers for 30-day perps volume on @DefiLlama!), their new launch on L2 @katana, and the fact that they are bringing their omnichain liquidity to Botanix and will be one of 16 inaugural node operators on it as well!

Check out the video below to learn more, visit the Vertex site to get started trading 60+ perps and spot markets, and stay tuned as we continue shining a light on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are quite green today. Fastest-growing chains on the weekly with at least $50M TVL are Hydration, Stellar, and Sui.

Protocols are also quite green today. Fastest-growing protocols on the weekly with at least $50M TVL are Tulipa Capital (categorized as a multichain Risk Curator), Cetus (uncategorized Aptos/Sui protocol), and Yearn Curating (categorized as an ETH/Base Risk Curator).

Here’s The Top 12 Chains By TVL (from @DefiLlama):

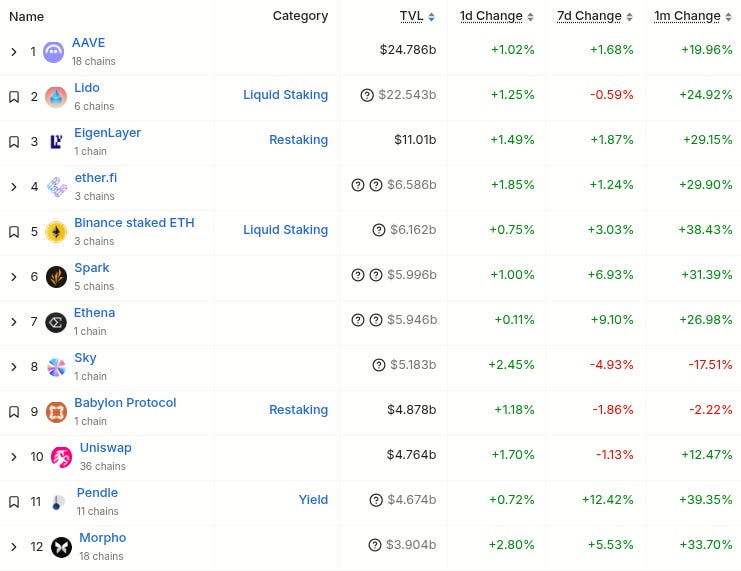

Here’s The Top 12 Protocols By TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Here’s The Top 10 Dex’s By 24 Hour Volume (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-30.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-24.00% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-15.00% APY on the August Mezo tBTC strategy - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-11.60% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-16.22% APY on USDS on Yearn h/t DefiLlama research

-12.68% APY on GHO on Aave V3 h/t DefiLlama research

-10.39% APY on USDO++ on Usual h/t DefiLlama research

-9.96% APY on USDC on Stream Finance h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-New project called @stable. Twitter bio states “A stablechain backed by @bitfinex and @USDT0_to”. Followed by 100 of our mutuals. h/t @AresLabs_xyz (note: more info on this one down in the News section):

-New project called @SovaBTC. Twitter bio states “Stealth”. Followed by 5 of our mutuals. h/t @AresLabs_xyz and @PentAay:

-New project called @heavendex. Twitter bio states “let there be light”. Followed by 35 of our mutuals. h/t @AresLabs_xyz and @peacefuldecay:

Important News And Analysis

-Lots of headlines today that President Trump may be announcing a new Fed Chair soon… Jerome Powell’s tenure isn’t over for another year or so but many have speculated on whether Trump would nominate a “phantom Fed Chair” before then, since their forward guidance on rates would arguably be more important than Powell’s. Trump continues to castigate Powell on social media, and stated a couple days ago that Powell should do a 100 bps cut this month.

-After Circle’s IPO and massive re-pricing, we now have word that Gemini will be IPO’ing as well, and many are speculating that we could soon witness a deluge of such crypto IPO’s, h/t @coinbureau:

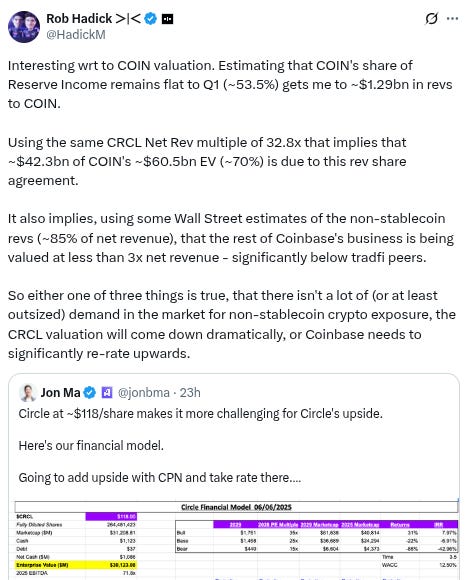

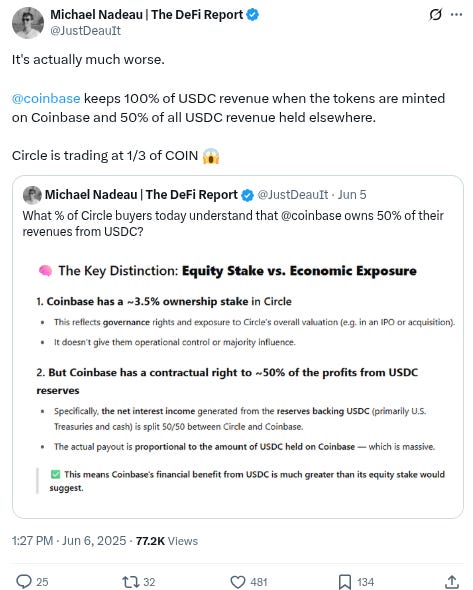

-Lot of comments to the effect that Circle/$CRCL is either overvalued or Coinbase/$COIN is undervalued, after the former shot up so high post-IPO this week, h/t @HadickM and @JustDeauIt:

-Excellent explanation from @0xDiplomat on the differences between new Tether-backed stablecoin chain @PlasmaFDN, and the new chain @stable (mentioned in the New Projects section above), which arrived on the scene over the last couple days and created much confusion based on its similarity to Plasma:

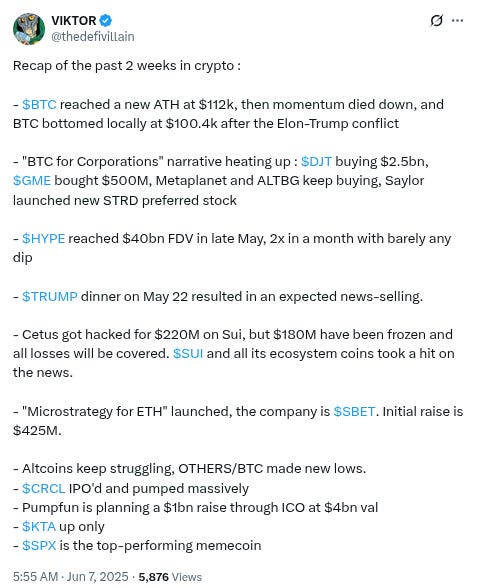

-Recap of last two weeks from @thedefivillain:

-InfoFi project @ethos_network continues to generate interest in airdrop circles, good overview from @jeg6322 below:

-World economy looking more and more accommodative for $BTC growth, as global sovereign debt crises heat up, h/t @fejau_inc:

-Coinbase CEO Brian Armstrong says that they have been aggressively trying to reduce issues with account freezes:

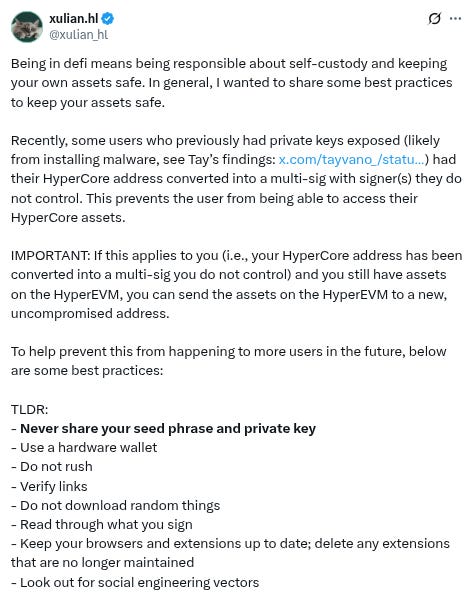

-Good info/advice on security from Hyperliquid’s @xulian_hl (below is part of much longer tweet, click to read in full):

-Large-scale proliferation of robots looking more and more possible every day, h/t @vitrupo:

-Interesting chart from @LukeGromen illustrating his theory that the most likely outcome for the US is neither a ‘Great Depression’ nor a Weimar-style ‘hyperinflation’, but rather several years of very high but not ‘hyper’ inflation, which is what Israel saw in the early 1980’s, when they had 4-5 years of roughly 100% inflation, then a return to normalcy once debt:gdp levels returned to manageable levels:

-New video featuring @im_manderson, @pythianism, and @MikeIppolito_ discussing everything going on in the crypto world:

-New video from @coinbureau on Bitcoin-mining companies:

-Weekly macro overview from Joseph Wang @FedGuy12:

-Parting (absolutely fascinating) images from @paoloardoino, of supermarket items in Bolivia priced in $USDT:

Conclusion

Happy Saturday good degens! Don’t forget to touch some grass this weekend!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.