Happy Tuesday friends! Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.72T

Gold: $2925.90

Oil (WTI): $66.85

US 10Y Treasury: 4.219%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

More bullish headlines from @maplefinance good degens!

Maple and their defi-facing instance @syrupfi recently hit over $700M in combined TVL, $5.5B in loans originated, and over 300k in monthly recurring revenue… and were selected by ETF-provider Bitwise for partnership on Bitwise’s first foray into defi!

As reported by @CoinDesk:

“Crypto asset manager and ETF provider Bitwise has made its first allocation into decentralized finance (DeFi) through a partnership with on-chain credit specialist Maple Finance...

Bitwise’s allocation, the size of which was not disclosed, is leveraging a Maple bitcoin-backed lending product, and represents a significant milestone in the adoption of on-chain credit by institutional allocators...

Learn more about about the above and everything else going on with Maple right now via the excellent thread from @GL_Capital_ below! And make sure to stay tuned as we continue rolling out more updates on everything the team is shipping!

Biggest TVL Movers + Else

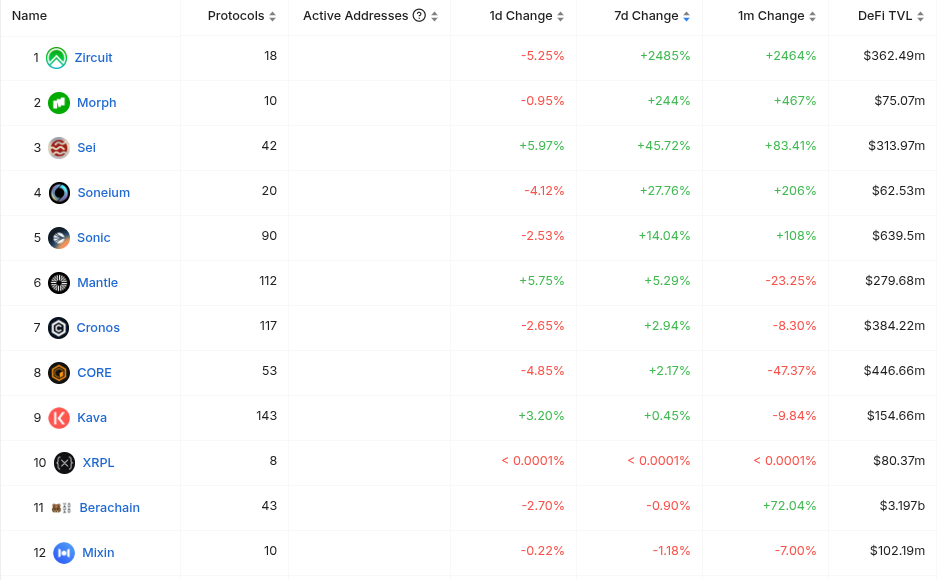

Chains are very red today. Only top 25 chains green on the weekly are Sonic (#13), Core (#16), Cronos (#17), Zircuit (#18), Sei (#20), and Mantle (#22).

Protocols are also very red today. Only top 25 protocols green on the weekly are Ethena (#4), Pendle (#6), Veda (#15), and Infrared Finance (#19).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $50M TVL (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $50M TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Revenue Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @flyingtulip_. No Twitter bio. Followed by 55 of our mutuals. h/t @AresLabs_xyz:

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $1M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-Markets still down and news uncertain this morning, h/t @Tyler_Did_It:

-$BMT/Bubblemaps airdrop is live, h/t @DeFiIgnas:

-ETH/BTC ratio reaching lows not seen for almost half a decade, h/t @Tyler_Did_It:

-All sorts of carnage on the TL (note: always hard to tell what is copy-pasta but either way is omnipresent right now):

-Sonic’ Shadow Exchange only at a $14M market cap despite being one of only current bright spots in market, h/t @Cryptoyieldinfo:

-Aave x Polygon conflict continues (note: we try not to highlight ‘drama’ typically but for stuff that’s relevant to major crypto assets we do like to make readers aware of it in case it impacts investing decisions, etc):

-“I think people are underestimating the strength of the Executive Order.” - @MattHougan:

-China deflation crisis as bullish catalyst, h/t @DTAPCAP:

-China deflation + US real estate problems + fiscal dominance as positive catalysts, h/t @billbarrX:

-Interesting long-form thoughts on crypto right now, from @alpha_pls:

-Interesting new macro discussion from Mike Green, Harley Bassman, and Michael Howell:

-Will we see a sharp v-reversal like in 2020? h/t @AltcoinPsycho:

-Parting wisdom from @rjiang5 via @QuotableCrypto:

Conclusion

Have a great Tuesday friends and hang in there!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.