Happy Saturday friends! Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $2.76T

Gold: $3090.00

Oil (WTI): $69.36

US 10Y Treasury: 4.253%

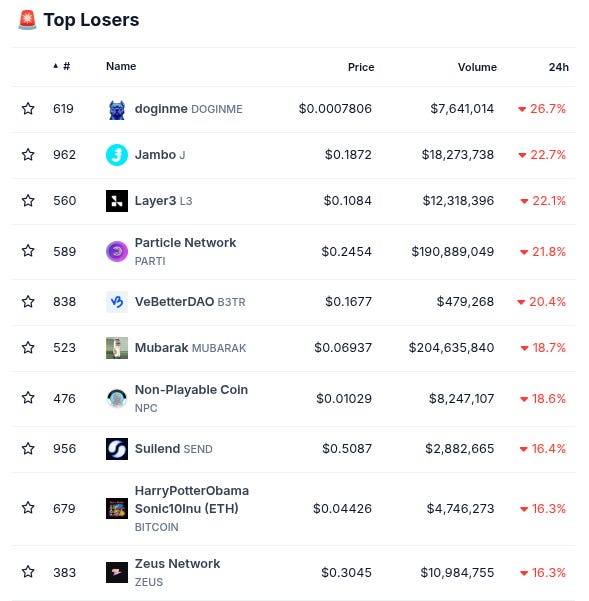

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Take heed good anons! An extremely cool new project you should know about is @upshift_fi!

Upshift sits at the heart of the nascent defi renaissance we are witnessing, and has already attracted over $200M in TVL!

There’s alot of bullish surface area on Upshift but one way we might describe it is “a yield protocol on steroids for the institutional age of defi”.

Upshift was founded by @aya_kantor and @AElkrief, and you can learn more about it via Aya’s recent interview with The Block’s @fintechfrank below!

You can also learn more via their docs, and make sure to follow them on Twitter for more updates!

Biggest TVL Movers + Else

Chains are quite red today. Only top 100 chains green on all three timelines (daily, weekly, monthly) are Radix (#43), and Cronos zkEVM (#80).

Protocols are quite red as well. Only top 100 protocols green on all three timelines (daily, weekly, monthly) are Kodiak (#41), Tether Gold (#46), Ethereal (#47), Paxos Gold (#56), Defi Saver (#88), and Superstate (#93).

Here’s The Top 12 Fastest-Growing Chains By TVL On The Weekly With At Least $1M TVL (from @DefiLlama):

Here’s The Top 12 Fastest-Growing Protocols By TVL On The Weekly With At Least $1M TVL (from @DefiLlama):

Here’s The Top Entities By 24 Hour Revenue Generation (from @DefiLlama):

Here’s The Top 12 Dex’s By 7 Day Volume (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @vibe_trading. Twitter bio states “Instant perps trading | Memecoins to Majors | Deepest liquidity | Seamless listings | Powered by @symm_io” Followed by 28 of our mutuals.

-Something new called @AtlantisOnSonic. Twitter bio states “Unlock Liquidity, unleash possibilities. The first Launchpad&Dex built on @SonicLabs . Dive into Atlantis at the highest speed.🔱” Followed by 10 of our mutuals.

-New project called @UFBots. Twitter bio states “Fight Club for Robots | $5 for 10min | Remote Control from Anywhere | Built by @frodobots” Followed by 9 of our mutuals. h/t @AresLabs_xyz:

-New project called @dopplerprotocol. Twitter bio states “custom capital markets | by @whetstonedotcc”. Followed by 5 of our mutuals. h/t @AresLabs_xyz and @inkonchain:

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (all types, $1M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-All eyes on April 2nd tariff stuff and what the market action will be surrounding it, h/t @DaanCrypto:

-pumpdotfun’s new version of Raydium is seeing success and appears so far to be the “winner” vs Raydium’s new version of pumdpotfun (note: for those who are not aware new tokens on pumpdotfun used to be automatically LP’d on Raydium once they reached a specific size, but pumpdotfun has created their own full amm to no longer rely on Raydium for this), h/t @NPC_68:

-The Wayfinder/$PROMPT TGE will apparently be slightly delayed into Q2, h/t @NaesYelof:

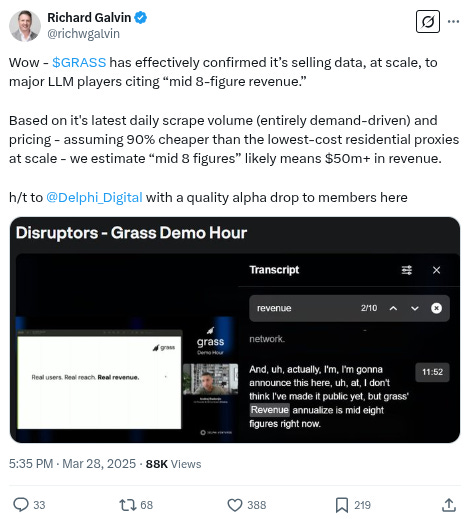

-Lot of bullish talk about $GRASS today, h/t example from @richwgalwin:

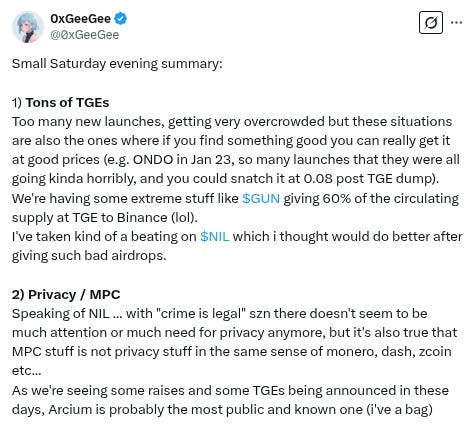

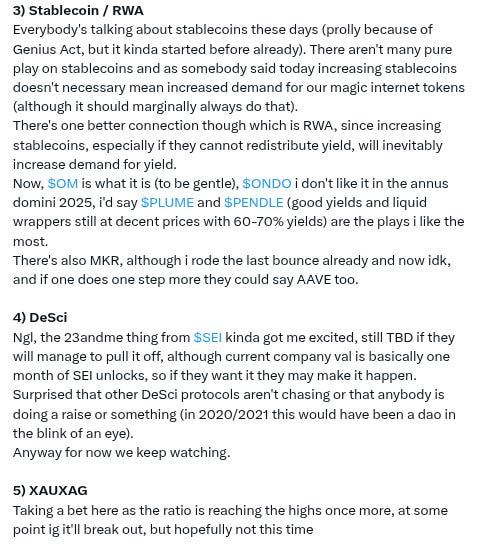

-Good rabbit-hole maxxing possibilities from @0xGeeGee:

-Does it still pay to be bearish when a full 51% of Americans believe we have another stock market crash on the horizon? h/t interesting thoughts from @BittelJulien:

-Some new AI tools to try out, from @sandraaleow:

-Absolutely fascinating saga chronicled by @OlimpioCrypto the last two days where candidates for a $125k/yr Arbitrum OAT council position are able to buy governance votes towards being selected for the position:

-Interesting stat from @hmalviya9 that would contrast greatly vs last cycle when it was more AMM emissions and token bribes and etc that really drove liquidity provision, whereas it would appear the earnings of LP’s are being driven more by actual trading fees now:

-Some current airdrop possibilities h/t @NPC_68:

-Seeing multiple separate stories on the TL today about weird stuff happening with Apple deliveries, so perhaps something to be aware of from a security standpoint, example c/o @MikeBotkin_ below:

-Fascinating new article from @donnellybrent that argues in favor of dollar weakness going forward, discusses a host of other topics, and also comments on the story about GameStop trying copy the Saylor MicroStrategy $BTC flywheel: “I have a ton of respect for the crazy moral hazard trade that Michael Saylor has engineered in bitcoin… On the other hand, the copycats buying bitcoin for the first time at $88,000 in an attempt to boost money-bleeding operations when their stock is already trading at 2X book value smack more of desperation and a lack of creativity than mad genius, gunslinging, or Cyberhornet awesomeness.”

-New video on everything airdrop-related from @KryptoCove:

-New video of Berachain yield farming opportunities from @0xMughal:

-New macro/crypto video from @Jesseeckel_:

-Parting wisdom from @sjdedic:

Conclusion

Happy Saturday friends and don’t forget to touch some grass this weekend!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.