Happy Saturday friends! Bit late on today’s issue because both Twitter and Substack were down at different points today!

Much going on though so let’s get after it! :)

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.55T

QQQ (Nasdaq 100): $509.24

Gold: $3,356.90

Oil (WTI): $61.53

US 10Y Treasury: 4.509%

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Our friends at @vertex_protocol have been generating much attention for the sky-high APY’s that $VRTX-stakers have been receiving on their platform (40-50% most of the time as of late!), but what often gets overlooked is that they have also been providing some very solid returns on $USDC as well!

As seen in the tweet below from @vertexintern, those lending on Vertex have been receiving an absolutely stellar return as of late!

In related (and equally bullish) news, Vertex’s omnichain liquidity system Vertex Edge is currently ranked #3 overall among all perps providers for 7-day perps volume on @DefiLlama!

Visit the Vertex site now to get started trading 60+ perps and spot markets, and stay tuned as we continue shining a light on everything they are doing!

Biggest TVL Movers + Other Interesting Data

Chains are mixed today. Top 25 chains up at least 10% on the weekly include Avalanche (#9), Hyperliquid L1 (#10), and BSquared (#18).

Protocols are also mixed today. Top 50 protocols up at least 10% on the weekly include DeSyn Protocol (#28), Maple Finance (#36), and Lista DAO (#38).

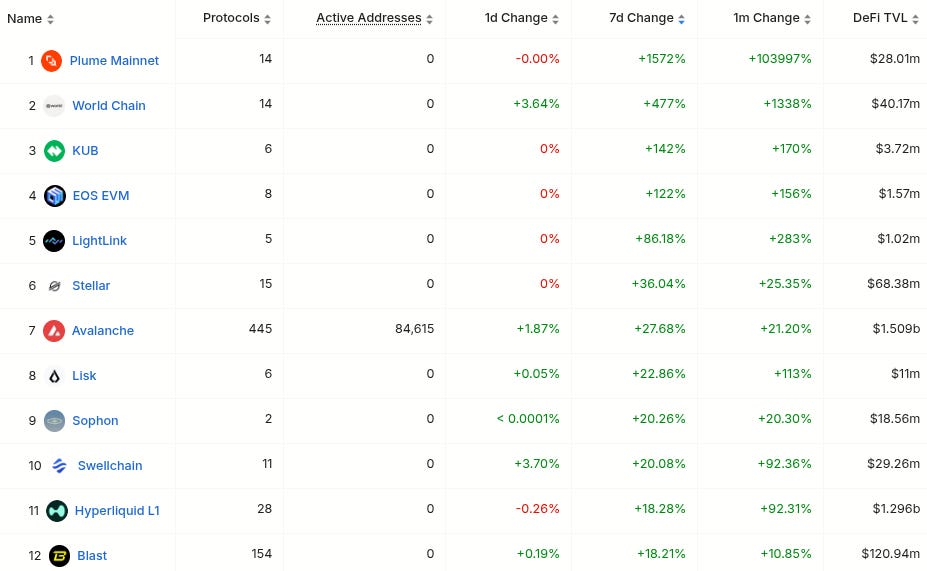

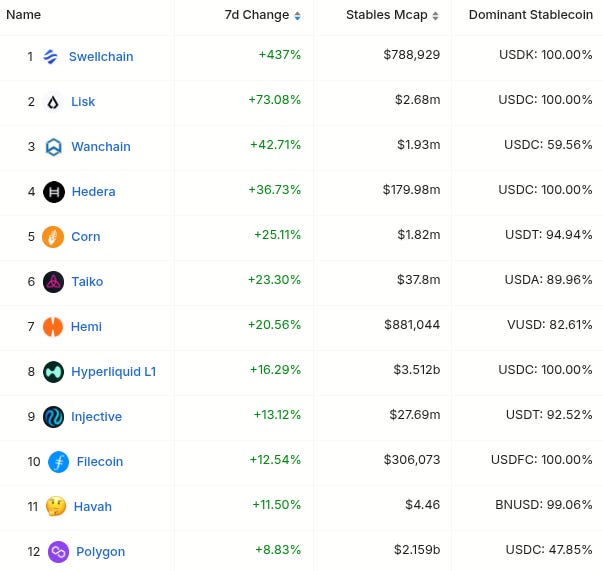

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $1M TVL: (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $1M TVL: (from @DefiLlama):

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Here’s The Top Chains By 7 Day Stablecoin Inflow % (from @DefiLlama):

Here’s The Top Dex’s By 7 Day Volume (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-11.49% APY on Avalanche AUSD strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-30.00% APY on Injective USDT strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-30.00% APY on Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-8.30% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-Varied and massive HyperEVM airdrop exposure on Hyperbeat Ultra HYPE vault - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-12.78% APY on GHO on Aave V3 h/t DefiLlama research

-12.17% APY on USDO++ on Usual h/t DefiLlama research

-11.49% APY on USDC on Stream Finance h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

-9.53% APY on USDC on Tokemak h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

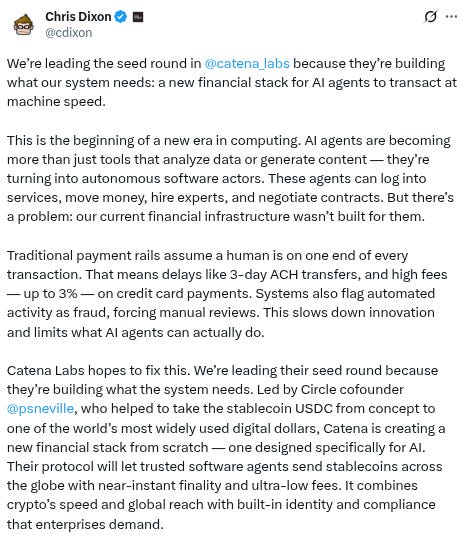

-Something new called @catena_labs. Twitter bio states “We're building the first AI-native financial institution to provide the financial infrastructure & services AI systems need to transact safely and efficiently.” Followed by 36 of our mutuals. h/t @cdixon:

-Something new called @LuckyFuture_AI has been added to @DefiLlama, categorized as a derivatives protocol on Solana, listed as having $55M TVL. Twitter bio states “AI-based ETF with Yields, Empowers Perp Lend Earn in One.” Followed by 1 of our mutuals.

Important News And Analysis

-Once again, Twitter/X was down much of today (as was Substack), and in related news Elon is now apparently back to 100% focus on Twitter/X and Tesla:

-@thedefivillain on the top performers since the recent market bottom:

-Discussion about the Treasury changing the supplementary leverage ratio, h/t @LynAldenContact:

-$HUMA airdrop checker is apparently now live, h/t @alpha_pls:

-Will we see a substantially weaker dollar over the next 1-2 years that will push stocks and crypto higher? h/t @AndreasSteno:

-Upcoming conference ETH Milan 2025 - “the largest web3 conference in Italy - the 24th of June, 2025”- is generating attention (some friends of ours are involved with this but we consider it newsworthy so we’re including it in this section :) ):

-More and more focus on Saylor and the $MSTR-trade and similar ones, h/t @nic__carter:

-@thedefivillain with thoughts on same subject (and quote-tweeting same tweet):

-Upcoming $RESOLV airdrop is generating excitement, h/t @castle_labs and @mattdotfi (click to real long-form article in full):

-Good overview thread of all recent airdrops and etc with links to checkers and other notable resources, from @Earndrop_io c/o @OlimpioCrypto:

-Reminder to input your Solana wallet on Kaito so you don’t miss any future airdrops!

-New Q&A from macro gigabrain @LukeGromen:

-New Steady Lads roundtable (aired yesterday):

-Weekly macro overview from Joseph Wang @FedGuy12:

-Newest episode of ‘TAO Talk’ from @Blocmatesdotcom:

-New yield farming video from @phtevenstrong The Calculator Guy:

-Parting thoughts from Treasury Secretary Scott Bessent:

Conclusion

Have a great Saturday friends and try to do some good grass-touching this weekend!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.